|

|

Post by Pacifico on Jul 11, 2023 17:12:28 GMT

Define a large population - Switzerland is a fair size, Hing Kong is a fair size, Singapore is a fair size - even the UK used to have fairly low corporate tax rates to attract business. One big enough to not be able to survive on the lowered taxes from corporations. In real numbers about 10 million. Of course what the countries affected by these countries stealing their taxes should do is ostracise them. Luxembourg was forced to reform its corporate tax laws. If you cut corporation tax rates the amount of corporation tax receipts go up - see Ireland. Basic Laffer curve. |

|

|

|

Post by zanygame on Jul 11, 2023 18:26:28 GMT

One big enough to not be able to survive on the lowered taxes from corporations. In real numbers about 10 million. Of course what the countries affected by these countries stealing their taxes should do is ostracise them. Luxembourg was forced to reform its corporate tax laws. If you cut corporation tax rates the amount of corporation tax receipts go up - see Ireland. Basic Laffer curve. Not the laughter curve again. They went up in Ireland because it doesn't need much tax for such a small population so nicking other countries corporate tax is enough to get you by. |

|

|

|

Post by Pacifico on Jul 11, 2023 21:09:20 GMT

If you cut corporation tax rates the amount of corporation tax receipts go up - see Ireland. Basic Laffer curve. Not the laughter curve again. They went up in Ireland because it doesn't need much tax for such a small population so nicking other countries corporate tax is enough to get you by. Nobody is nicking anything - taxation rates, like pay rates, property taxes and government subsidy are all factors in a competitive environment. And as much as you dislike it, we live in a competitive environment. |

|

|

|

Post by zanygame on Jul 11, 2023 21:47:59 GMT

Not the laughter curve again. They went up in Ireland because it doesn't need much tax for such a small population so nicking other countries corporate tax is enough to get you by. Nobody is nicking anything - taxation rates, like pay rates, property taxes and government subsidy are all factors in a competitive environment. And as much as you dislike it, we live in a competitive environment. If you invite corporations from other countries to pay their taxes in your country at a low rate, then as far as I'm concerned they are thieves. |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jul 11, 2023 22:25:04 GMT

Nobody is nicking anything - taxation rates, like pay rates, property taxes and government subsidy are all factors in a competitive environment. And as much as you dislike it, we live in a competitive environment. If you invite corporations from other countries to pay their taxes in your country at a low rate, then as far as I'm concerned they are thieves. In the spirits of common decency your concerns are noted, but aren't really relevant to the situation. We need to survive within a global system with a lot of competition. This is just the way of things right now, so low rates is better than a kick in the nuts. If the banks stop debanking wonderfully pro-British people then perhaps British business growth can counter it. |

|

|

|

Post by zanygame on Jul 12, 2023 6:30:40 GMT

If you invite corporations from other countries to pay their taxes in your country at a low rate, then as far as I'm concerned they are thieves. In the spirits of common decency your concerns are noted, but aren't really relevant to the situation. We need to survive within a global system with a lot of competition. This is just the way of things right now, so low rates is better than a kick in the nuts. If the banks stop debanking wonderfully pro-British people then perhaps British business growth can counter it. You raise a good point. Its why we have trade barriers deals etc around the world. Its why things like the EU exist. I'm sure that if you were allowed to pay your income tax in Antigua you would gladly do so, but your government does not allow you to work and live in the UK and not pay your dues here. The same is true to an extent with corporations. The EU stopped amazon from declaring profits made in the EU in countries offshore. Trump did the same in America. |

|

|

|

Post by Dan Dare on Jul 12, 2023 8:04:52 GMT

Someone mentioned Ireland earlier and its deployment of corporation tax as a predatory weapon. This is certainly the case of Apple, whose Irish subsidiary declares its entire global revenues and profits in Ireland, with the exception of the USA. This is one of the reasons why Ireland's GDP per capita is so high. Apple, for instance has only 6,000 employees in Ireland but the company's international operations, located in Ireland, reported $69 billion profit in 2022 on $211 billion revenue. appleinsider.com/articles/23/04/07/apples-irish-subsidiary-rakes-in-693-billion-profit-from-global-operations |

|

|

|

Post by zanygame on Jul 12, 2023 17:02:25 GMT

Someone mentioned Ireland earlier and its deployment of corporation tax as a predatory weapon. This is certainly the case of Apple, whose Irish subsidiary declares its entire global revenues and profits in Ireland, with the exception of the USA. This is one of the reasons why Ireland's GDP per capita is so high. Apple, for instance has only 6,000 employees in Ireland but the company's international operations, located in Ireland, reported $69 billion profit in 2022 on $211 billion revenue. appleinsider.com/articles/23/04/07/apples-irish-subsidiary-rakes-in-693-billion-profit-from-global-operationsWhich is why it needs stopping. Apple should pay tax where apple operates. |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jul 13, 2023 10:22:02 GMT

The Tories have basically brought on this growth / fiscal crisis themselves - they are to blame

Possibly the worlds leading economist is Paul Krugman, Nobel Prize winning economist and professor at several world leading institutions including The London School Of Economics and Princeton University.

His assertion that too much austerity defeats the object makes much sense, because if you think about it, you take money and resources OUT of the economy, it is surely going to hit growth, and the greatest weapon against debt and deficit is ... growth.

In 2010, before the general election, this argument was put forward not only by Gordon Brown and Alistair Darling, but also by Nick Clegg, Vince Cable and many others - however, after the election the Lib Dems who promoted the argument suddenly changed their minds.

The technical name for what the Tories did is PARADOX OF THRIFT - (quote) "Across an economy, one person's spending is another person's income. In other words, if everyone is trying to reduce their spending, the economy can be trapped in what economists call the paradox of thrift, worsening the recession as GDP falls"

Evidence ... In the first quarter of 2010, growth was accelerating after we had come out of recession, then the Tories came to power and shortly after that growth plummeted, and we almost went into a second recession (the double dip).

The higher our growth is - the quicker and lower our deficit becomes as a percentage of GDP, the REAL measure, the measure that counts.

And to think that the Conservatives were once regarded as the best guardians of the economy, how things do change.

|

|

|

|

Post by Pacifico on Jul 13, 2023 17:50:00 GMT

Sid busily re-writing history again..  In 2010 all 3 party's were promising massive cuts - as it happens, no massive cuts materialised...  |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jul 13, 2023 20:59:56 GMT

There was no doubt that Gordon Brown and Alistair Darling intended to cut spending, they had a "Recovery Budget" in the March of 2010, the result of which would have reduced the deficit to £163 billion for the financial year.

The George Osborne budget of June 2010 was forecast to redude the deficit to £149 billion

As stated previously, less cuts, over a longer period of time

EVERY forecast made by George Osborne in his first budget never came true - his forecasts on future growth were way off target, his forecast that his policies would result in a budget surplus by 2015 never came true - he predicted that unless we implemented his policies, the UK would lose its AAA Credit Rating.

The UK lost its AAA Credit Rating in 2013

|

|

|

|

Post by Pacifico on Jul 13, 2023 21:35:04 GMT

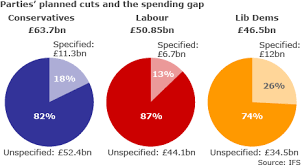

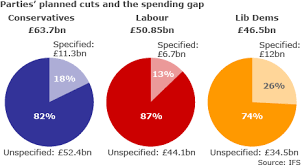

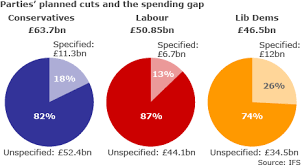

There was no doubt that Gordon Brown and Alistair Darling intended to cut spending, they had a "Recovery Budget" in the March of 2010, the result of which would have reduced the deficit to £163 billion for the financial year. The George Osborne budget of June 2010 was forecast to redude the deficit to £149 billion As stated previously, less cuts, over a longer period of time EVERY forecast made by George Osborne in his first budget never came true - his forecasts on future growth were way off target, his forecast that his policies would result in a budget surplus by 2015 never came true - he predicted that unless we implemented his policies, the UK would lose its AAA Credit Rating. The UK lost its AAA Credit Rating in 2013 Did his forecast of cutting £63 Billion come true? - a simple yes or no will suffice.. |

|

|

|

Post by see2 on Jul 15, 2023 14:25:59 GMT

Sid busily re-writing history again..  In 2010 all 3 party's were promising massive cuts - as it happens, no massive cuts materialised...  So you remember the huge black hole left by the International Financial Meltdown. That's pretty good for a Tory. |

|

|

|

Post by dodgydave on Jul 15, 2023 15:49:45 GMT

Someone mentioned Ireland earlier and its deployment of corporation tax as a predatory weapon. This is certainly the case of Apple, whose Irish subsidiary declares its entire global revenues and profits in Ireland, with the exception of the USA. This is one of the reasons why Ireland's GDP per capita is so high. Apple, for instance has only 6,000 employees in Ireland but the company's international operations, located in Ireland, reported $69 billion profit in 2022 on $211 billion revenue. appleinsider.com/articles/23/04/07/apples-irish-subsidiary-rakes-in-693-billion-profit-from-global-operationsWhich is why it needs stopping. Apple should pay tax where apple operates. They do... there are more taxes than Corporation Tax lol. Corporation Tax is a political tax, nobody in the real world cares about it... because it is a tax ON A PAPER FIGURE, and companies can decide what that paper figure is!! I've told you this time and time again, you go to any tax collection office and there will be 99 people collecting the real taxes (income tax, national insurance, capital gains, dividends tax etc) and there will be 1 person working part-time on corporation tax... and they will spend half their time fending off local MPs and business leaders who want non-paying companies to stay in their area to provide jobs and spend money in the local area. |

|

|

|

Post by Pacifico on Jul 15, 2023 17:25:54 GMT

Sid busily re-writing history again..  In 2010 all 3 party's were promising massive cuts - as it happens, no massive cuts materialised...  So you remember the huge black hole left by the International Financial Meltdown. That's pretty good for a Tory. Yes - I remember Crash Gordon thinking he saved the world.. Makes Biden look totally with it.. |

|