|

|

Post by Pacifico on Oct 29, 2023 11:35:07 GMT

So you are saying that the energy prices that we have seen for the past 2 years are the new norm?  No, that we have found new sources of power reducing the need for gas and thus reducing demand and lowering prices, just not back to pre war levels. Even if the Ukraine war ends, its doubtful we will be buying Russian gas for quite a while.

No - but other countries are. China is buying vast amounts of Russian gas at very cheap prices - but while they are buying Russian gas they are not buying gas from other sources (sources that are supplying us), this allows the market to stabilise back to its normal levels. |

|

|

|

Post by zanygame on Oct 29, 2023 17:27:01 GMT

No, that we have found new sources of power reducing the need for gas and thus reducing demand and lowering prices, just not back to pre war levels. Even if the Ukraine war ends, its doubtful we will be buying Russian gas for quite a while.

No - but other countries are. China is buying vast amounts of Russian gas at very cheap prices - but while they are buying Russian gas they are not buying gas from other sources (sources that are supplying us), this allows the market to stabilise back to its normal levels. But it hasn't has it? If you believe they will return to post war levels that's your guess. Mine is that it will take years. One thing that will bring prices down is the switch to renewables. That's what happened to coal. |

|

|

|

Post by Pacifico on Oct 29, 2023 17:47:24 GMT

No - but other countries are. China is buying vast amounts of Russian gas at very cheap prices - but while they are buying Russian gas they are not buying gas from other sources (sources that are supplying us), this allows the market to stabilise back to its normal levels. But it hasn't has it? If you believe they will return to post war levels that's your guess. Mine is that it will take years.

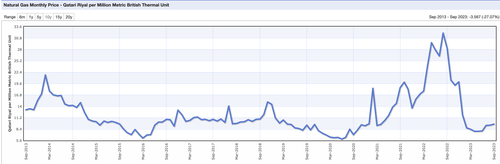

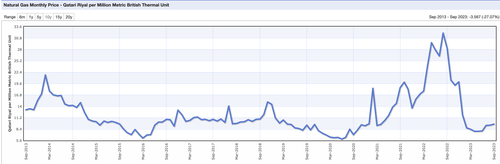

One thing that will bring prices down is the switch to renewables. That's what happened to coal. Not sure what you are talking about - the price of Qatar gas is already down to normal levels.  |

|

|

|

Post by zanygame on Oct 29, 2023 17:49:42 GMT

But it hasn't has it? If you believe they will return to post war levels that's your guess. Mine is that it will take years.

One thing that will bring prices down is the switch to renewables. That's what happened to coal. Not sure what you are talking about - the price of Qatar gas is already down to normal levels.  That's good news. Maybe the price we pay will follow. I genuinely hope you are right. |

|

|

|

Post by Pacifico on Oct 30, 2023 7:08:24 GMT

Good article in todays paper explaining why wind power is so expensive. The maximum strike price the Government offered was £44 per MWh. According to RWE it won’t receive any bids until this is raised to between £65 and £75.

How come, when the cost of wind energy is supposed to be falling year on year? True, the cost did fall sharply up until 2019. But this then went into reverse thanks to higher commodity prices and interest rates. With renewable energy, most of the costs come upfront – which makes it particularly reliant on cheap debt.

But this is only half the story. If we are going to have a grid based on intermittent renewables, it is no use looking just at the cost of generation. We have to add on the cost of energy storage, or some other kind of back-up – or else build so many wind and solar farms that we have just enough power at the worst of times, and a super-abundance of it at other times.

All are likely to be horrendously expensive. Storing energy in lithium batteries, for example, can cost around six times as much as generating it in the first place. Using gas as back-up – as we do now – means we have gas power stations sitting idle for some periods, pushing up the unit cost of generation when they are needed.

As for super-abundance, we would end up with masses of idle wind turbines and solar panels instead. They would only get built if their owners were bribed with huge compensation for being unable to supply all their power to the grid.

Wind farms already do receive such “constraint payments”, which inevitably end up on our bills. In 2022, energy consumers – unknowingly in most cases – had to pay £215 million to wind farm owners to turn off their turbines. This is a bill that is surely only going to rise as more and more wind farms – and far too few energy storage facilities – are connected to the grid.

Remember how, last summer, the renewables lobby was trying to tell us that wind energy was “nine times cheaper” than gas? It was a blatantly false comparison between long-term strike prices for wind and “day ahead” prices for gas – ie the inflated prices we have to pay the owners of gas power stations to turn them on for a few hours at short notice when wind and solar are in short supply. We are paying more than we need to for gas power because we are using it to balance renewables.

The case for wind power was built upon a myth |

|

|

|

Post by zanygame on Oct 30, 2023 10:03:40 GMT

Good article in todays paper explaining why wind power is so expensive. The maximum strike price the Government offered was £44 per MWh. According to RWE it won’t receive any bids until this is raised to between £65 and £75.

How come, when the cost of wind energy is supposed to be falling year on year? True, the cost did fall sharply up until 2019. But this then went into reverse thanks to higher commodity prices and interest rates. With renewable energy, most of the costs come upfront – which makes it particularly reliant on cheap debt.

But this is only half the story. If we are going to have a grid based on intermittent renewables, it is no use looking just at the cost of generation. We have to add on the cost of energy storage, or some other kind of back-up – or else build so many wind and solar farms that we have just enough power at the worst of times, and a super-abundance of it at other times.

All are likely to be horrendously expensive. Storing energy in lithium batteries, for example, can cost around six times as much as generating it in the first place. Using gas as back-up – as we do now – means we have gas power stations sitting idle for some periods, pushing up the unit cost of generation when they are needed.

As for super-abundance, we would end up with masses of idle wind turbines and solar panels instead. They would only get built if their owners were bribed with huge compensation for being unable to supply all their power to the grid.

Wind farms already do receive such “constraint payments”, which inevitably end up on our bills. In 2022, energy consumers – unknowingly in most cases – had to pay £215 million to wind farm owners to turn off their turbines. This is a bill that is surely only going to rise as more and more wind farms – and far too few energy storage facilities – are connected to the grid.

Remember how, last summer, the renewables lobby was trying to tell us that wind energy was “nine times cheaper” than gas? It was a blatantly false comparison between long-term strike prices for wind and “day ahead” prices for gas – ie the inflated prices we have to pay the owners of gas power stations to turn them on for a few hours at short notice when wind and solar are in short supply. We are paying more than we need to for gas power because we are using it to balance renewables.

The case for wind power was built upon a mythLets deal with each point. High commodity prices? So the same problem caused by the fuel price. And high interest rates, based on the Governments attempts to reduce inflation caused by the fuel price. Seems gas is even scuppering renewables, but it temporary. This is a good point, but as far as I know these costs are already built into the build costs. The only bit that isn't is the cost of building infrastructure to move it across the country. But once this is built the cost drops dramatically. As far as I know no one is seriously considering battery storage on any kind of scale. Super abundance as an idea is that a larger area, say Europe shares the generation and supply. Also what we are now already seeing with usage switching to night time. Don't you find it annoying when bloggers use numbers to shock. £215m sounds huge, until you see that against the total sum of 26.3Bn so 1%. I don't agree it will rise if this crappy government resigns and we get the connections built and we continue with the switch to night time charging and usage. We are not using gas to subsidise renewables, that is obvious if you compare the sales price of each. Renewables are reducing the amount of gas mWh we have to buy at £110 quid a time |

|