|

|

Post by zanygame on Jan 11, 2024 17:14:25 GMT

I didn't propose a methodology. But if pressed I would price freeze staple foods and pay signed up supermarkets the difference. And fix the price on the 1st 6kwh of electricity used each day. Or raise taxes the the equivalent of what the mortgage rate rises are costing. I have argued before that since the purpose of interest rate increases is to reduce inflationary pressures by taking money out of peoples pockets, interest rate hikes are actually a very unfair way of doing it because it is so hit and miss and takes no account of who has the most money to spend. It falls exclusively on mortgage payers and holders of other debts, some of both groups struggling financially already. Buy to let landlords inevitably try to pass some of these increased costs onto tenants via big rent hikes, hitting some of the poorest. Whilst those with the most wealth are far more likely to remain untouched and indeed be net gainers from the rate rises. And the additional moneys extracted do little more socially constructive than increase the profits of banks and other lenders. Raising taxes temporarily instead of interest rates would be far more effective and far fairer, exempting the poor entirely, whilst everyone else pays more or less according to their wealth levels or income streams. And the monies raised could be used for social good that would benefit us in the medium to long term, eg by building social housing. As opposed to merely boosting bankers' profits. Instead of using interest rates to dampen demand, we could use an anti-inflation levy on incomes, applied when inflation is too high and set at the necessary level to be effective, then reduced, ideally back to zero when inflation is under control. Interest rates meanwhile can stay low with businesses still able to borrow cheaply for investment. It actually makes far more economic sense to anyone not prone to kneejerk and/or ideologically driven responses. Yep. its a very convincing argument. Only the pretend bogey man of the rich fleeing the country stops it happening. You could almost do it automatically by making tax based on inflation rate. |

|

|

|

Post by Pacifico on Jan 11, 2024 17:24:22 GMT

I didn't propose a methodology. But if pressed I would price freeze staple foods and pay signed up supermarkets the difference. And fix the price on the 1st 6kwh of electricity used each day. Or raise taxes the the equivalent of what the mortgage rate rises are costing. I have argued before that since the purpose of interest rate increases is to reduce inflationary pressures by taking money out of peoples pockets, interest rate hikes are actually a very unfair way of doing it because it is so hit and miss and takes no account of who has the most money to spend. It falls exclusively on mortgage payers and holders of other debts, some of both groups struggling financially already. Buy to let landlords inevitably try to pass some of these increased costs onto tenants via big rent hikes, hitting some of the poorest. Whilst those with the most wealth are far more likely to remain untouched and indeed be net gainers from the rate rises. And the additional moneys extracted do little more socially constructive than increase the profits of banks and other lenders. Raising taxes temporarily instead of interest rates would be far more effective and far fairer, exempting the poor entirely, whilst everyone else pays more or less according to their wealth levels or income streams. And the monies raised could be used for social good that would benefit us in the medium to long term, eg by building social housing. As opposed to merely boosting bankers' profits. Instead of using interest rates to dampen demand, we could use an anti-inflation levy on incomes, applied when inflation is too high and set at the necessary level to be effective, then reduced, ideally back to zero when inflation is under control. Interest rates meanwhile can stay low with businesses still able to borrow cheaply for investment. It actually makes far more economic sense to anyone not prone to kneejerk and/or ideologically driven responses. The only tax that would achieve the same effect is a rise in VAT. If by raising interest rates you are trying to reduce demand then to replicate that effect you need to increase a tax that has a direct correlation with the level of demand. The nonsense that we get from certain posters that all you need to do is tax the rich would achieve nothing as they contribute a miniscule amount to total demand in the economy - they are more likely to reduce saving and thus demand remains unchanged. So higher interest rates or higher VAT - your choice |

|

|

|

Post by zanygame on Jan 11, 2024 18:03:23 GMT

I have argued before that since the purpose of interest rate increases is to reduce inflationary pressures by taking money out of peoples pockets, interest rate hikes are actually a very unfair way of doing it because it is so hit and miss and takes no account of who has the most money to spend. It falls exclusively on mortgage payers and holders of other debts, some of both groups struggling financially already. Buy to let landlords inevitably try to pass some of these increased costs onto tenants via big rent hikes, hitting some of the poorest. Whilst those with the most wealth are far more likely to remain untouched and indeed be net gainers from the rate rises. And the additional moneys extracted do little more socially constructive than increase the profits of banks and other lenders. Raising taxes temporarily instead of interest rates would be far more effective and far fairer, exempting the poor entirely, whilst everyone else pays more or less according to their wealth levels or income streams. And the monies raised could be used for social good that would benefit us in the medium to long term, eg by building social housing. As opposed to merely boosting bankers' profits. Instead of using interest rates to dampen demand, we could use an anti-inflation levy on incomes, applied when inflation is too high and set at the necessary level to be effective, then reduced, ideally back to zero when inflation is under control. Interest rates meanwhile can stay low with businesses still able to borrow cheaply for investment. It actually makes far more economic sense to anyone not prone to kneejerk and/or ideologically driven responses. The only tax that would achieve the same effect is a rise in VAT. If by raising interest rates you are trying to reduce demand then to replicate that effect you need to increase a tax that has a direct correlation with the level of demand. The nonsense that we get from certain posters that all you need to do is tax the rich would achieve nothing as they contribute a miniscule amount to total demand in the economy - they are more likely to reduce saving and thus demand remains unchanged. So higher interest rates or higher VAT - your choice Define the rich? A 15% rise in income tax would cost someone earning 50k a year around 6k a year more. £450 a month. About the same as the average mortgage increase. Someone on 100k would be taxed around an extra £1125 a month. Both would effect how much they spent. VAT doesn't work. Business not supplying essentials is forced to suck up most of the cost as they are already charging the maximum the market will bear. It also hits the poor hardest, which is why of course you prefer it. |

|

|

|

Post by Pacifico on Jan 11, 2024 18:28:47 GMT

As I said - the tedious tax the rich idea will not work as there simply is not enough of them to influence demand in the entire economy.  |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jan 11, 2024 19:18:40 GMT

I have argued before that since the purpose of interest rate increases is to reduce inflationary pressures by taking money out of peoples pockets, interest rate hikes are actually a very unfair way of doing it because it is so hit and miss and takes no account of who has the most money to spend. It falls exclusively on mortgage payers and holders of other debts, some of both groups struggling financially already. Buy to let landlords inevitably try to pass some of these increased costs onto tenants via big rent hikes, hitting some of the poorest. Whilst those with the most wealth are far more likely to remain untouched and indeed be net gainers from the rate rises. And the additional moneys extracted do little more socially constructive than increase the profits of banks and other lenders. Raising taxes temporarily instead of interest rates would be far more effective and far fairer, exempting the poor entirely, whilst everyone else pays more or less according to their wealth levels or income streams. And the monies raised could be used for social good that would benefit us in the medium to long term, eg by building social housing. As opposed to merely boosting bankers' profits. Instead of using interest rates to dampen demand, we could use an anti-inflation levy on incomes, applied when inflation is too high and set at the necessary level to be effective, then reduced, ideally back to zero when inflation is under control. Interest rates meanwhile can stay low with businesses still able to borrow cheaply for investment. It actually makes far more economic sense to anyone not prone to kneejerk and/or ideologically driven responses. The only tax that would achieve the same effect is a rise in VAT. If by raising interest rates you are trying to reduce demand then to replicate that effect you need to increase a tax that has a direct correlation with the level of demand. The nonsense that we get from certain posters that all you need to do is tax the rich would achieve nothing as they contribute a miniscule amount to total demand in the economy - they are more likely to reduce saving and thus demand remains unchanged. So higher interest rates or higher VAT - your choice Again, your response is ideologically driven, an assumption that any tax on income is worse than anything else, and particularly so if the rich have to pay it. The suggestion is not exclusively to make the rich alone pay, as you seem to be trying to imply, which would clearly not work as a means to reduce demand across the board and thereby reduce inflation. It would be to reduce the spending power of all earners in direct proportion to how much they earn, reducing the spending power of everyone except those already too poor to spend much. The rich would only pay the same percentage as all other earners. Interest rates work by taking money out of peoples pockets. They are relatively ineffective because they only hit some people, leaving many others as free to spend as they always were. A levy on income would do the same thing far more effectively and fairly, spreading the hit more widely across the board. It is in no way clear why VAT would work better just because it artificially increases prices. Indeed, if the aim is to reduce demand to lower inflation, artificially increasing prices would just be daft because it would actually seek to reduce demand by increasing inflation artificially. As a means of reducing inflation, therefore, increasing VAT would be idiotic. |

|

|

|

Post by zanygame on Jan 11, 2024 19:43:26 GMT

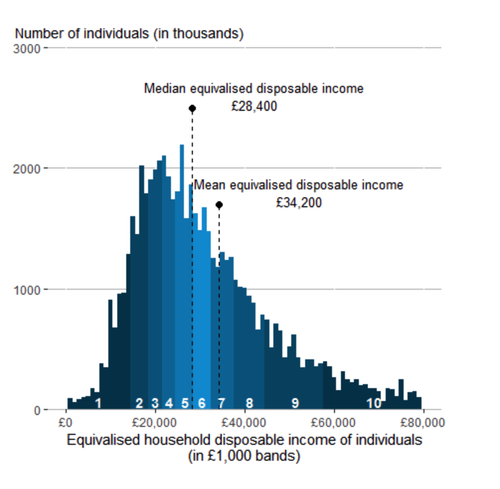

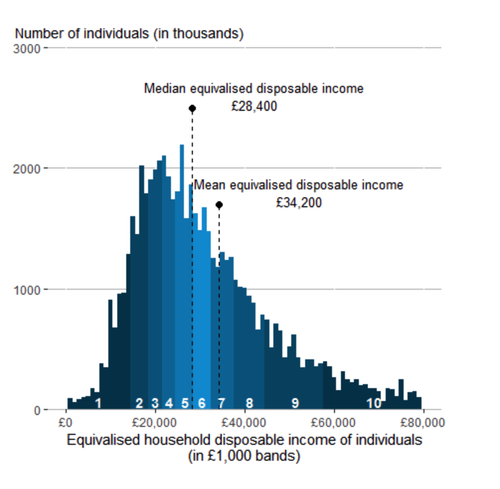

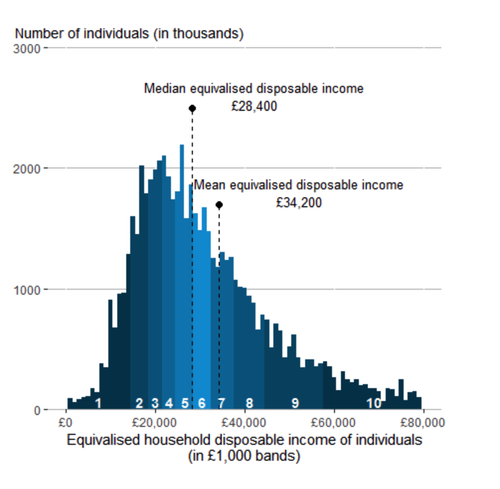

As I said - the tedious tax the rich idea will not work as there simply is not enough of them to influence demand in the entire economy.  What's that supposed to show me? 34% of households earn in excess of 50k a year. |

|

|

|

Post by zanygame on Jan 11, 2024 19:47:41 GMT

The only tax that would achieve the same effect is a rise in VAT. If by raising interest rates you are trying to reduce demand then to replicate that effect you need to increase a tax that has a direct correlation with the level of demand. The nonsense that we get from certain posters that all you need to do is tax the rich would achieve nothing as they contribute a miniscule amount to total demand in the economy - they are more likely to reduce saving and thus demand remains unchanged. So higher interest rates or higher VAT - your choice Again, your response is ideologically driven, an assumption that any tax on income is worse than anything else, and particularly so if the rich have to pay it. The suggestion is not exclusively to make the rich alone pay, as you seem to be trying to imply, which would clearly not work as a means to reduce demand across the board and thereby reduce inflation. It would be to reduce the spending power of all earners in direct proportion to how much they earn, reducing the spending power of everyone except those already too poor to spend much. The rich would only pay the same percentage as all other earners. Interest rates work by taking money out of peoples pockets. They are relatively ineffective because they only hit some people, leaving many others as free to spend as they always were. A levy on income would do the same thing far more effectively and fairly, spreading the hit more widely across the board. It is in no way clear why VAT would work better just because it artificially increases prices. Indeed, if the aim is to reduce demand to lower inflation, artificially increasing prices would just be daft because it would actually seek to reduce demand by increasing inflation artificially. As a means of reducing inflation, therefore, increasing VAT would be idiotic. Well said. |

|

|

|

Post by buccaneer on Jan 11, 2024 20:01:23 GMT

The only tax that would achieve the same effect is a rise in VAT. If by raising interest rates you are trying to reduce demand then to replicate that effect you need to increase a tax that has a direct correlation with the level of demand. The nonsense that we get from certain posters that all you need to do is tax the rich would achieve nothing as they contribute a miniscule amount to total demand in the economy - they are more likely to reduce saving and thus demand remains unchanged. So higher interest rates or higher VAT - your choice Again, your response is ideologically driven, an assumption that any tax on income is worse than anything else, and particularly so if the rich have to pay it. The suggestion is not exclusively to make the rich alone pay, as you seem to be trying to imply, which would clearly not work as a means to reduce demand across the board and thereby reduce inflation. It would be to reduce the spending power of all earners in direct proportion to how much they earn, reducing the spending power of everyone except those already too poor to spend much. The rich would only pay the same percentage as all other earners. Interest rates work by taking money out of peoples pockets. They are relatively ineffective because they only hit some people, leaving many others as free to spend as they always were. A levy on income would do the same thing far more effectively and fairly, spreading the hit more widely across the board. It is in no way clear why VAT would work better just because it artificially increases prices. Indeed, if the aim is to reduce demand to lower inflation, artificially increasing prices would just be daft because it would actually seek to reduce demand by increasing inflation artificially. As a means of reducing inflation, therefore, increasing VAT would be idiotic. So, you want the government to take control of a fundamental in monetary policy, so how would this work with the BoE who control the circulation of money? It appears you have a simple solution to a complex matter. |

|

|

|

Post by zanygame on Jan 11, 2024 20:07:05 GMT

Again, your response is ideologically driven, an assumption that any tax on income is worse than anything else, and particularly so if the rich have to pay it. The suggestion is not exclusively to make the rich alone pay, as you seem to be trying to imply, which would clearly not work as a means to reduce demand across the board and thereby reduce inflation. It would be to reduce the spending power of all earners in direct proportion to how much they earn, reducing the spending power of everyone except those already too poor to spend much. The rich would only pay the same percentage as all other earners. Interest rates work by taking money out of peoples pockets. They are relatively ineffective because they only hit some people, leaving many others as free to spend as they always were. A levy on income would do the same thing far more effectively and fairly, spreading the hit more widely across the board. It is in no way clear why VAT would work better just because it artificially increases prices. Indeed, if the aim is to reduce demand to lower inflation, artificially increasing prices would just be daft because it would actually seek to reduce demand by increasing inflation artificially. As a means of reducing inflation, therefore, increasing VAT would be idiotic. So, you want the government to take control of a fundamental in monetary policy, so how would this work with the BoE who control the circulation of money? It appears you have a simple solution to a complex matter. Well not THIS government. They created the need for the BofE to have to raise interest rates so high. But then they have to look after their sponsors. |

|

|

|

Post by buccaneer on Jan 11, 2024 20:13:34 GMT

So, you want the government to take control of a fundamental in monetary policy, so how would this work with the BoE who control the circulation of money? It appears you have a simple solution to a complex matter. Well not THIS government. They created the need for the BofE to have to raise interest rates so high. But then they have to look after their sponsors. They created this because people like you wanted the government to pay people to stay at home rather than work. This is the cost of Covid - very high public spending. The risk of inflation was well known 3 years ago. The BoE acted late on this. Have a read of this, this was written in 2021. www.briefingsforbritain.co.uk/inflation-the-main-threat-to-uk-economic-recovery/Note part 2: "Lax Monetary Policy Threatens to Derail the Recovery" |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jan 11, 2024 20:13:53 GMT

Again, your response is ideologically driven, an assumption that any tax on income is worse than anything else, and particularly so if the rich have to pay it. The suggestion is not exclusively to make the rich alone pay, as you seem to be trying to imply, which would clearly not work as a means to reduce demand across the board and thereby reduce inflation. It would be to reduce the spending power of all earners in direct proportion to how much they earn, reducing the spending power of everyone except those already too poor to spend much. The rich would only pay the same percentage as all other earners. Interest rates work by taking money out of peoples pockets. They are relatively ineffective because they only hit some people, leaving many others as free to spend as they always were. A levy on income would do the same thing far more effectively and fairly, spreading the hit more widely across the board. It is in no way clear why VAT would work better just because it artificially increases prices. Indeed, if the aim is to reduce demand to lower inflation, artificially increasing prices would just be daft because it would actually seek to reduce demand by increasing inflation artificially. As a means of reducing inflation, therefore, increasing VAT would be idiotic. So, you want the government to take control of a fundamental in monetary policy, so how would this work with the BoE who control the circulation of money? It appears you have a simple solution to a complex matter. Having the government in control is of course a potential problem. Governments tend to be swayed more by what wins support than by what is needed. Some mechanism by which the necessary rate is decided by an arms length body independent of government would be preferable. |

|

|

|

Post by zanygame on Jan 11, 2024 20:35:18 GMT

Well not THIS government. They created the need for the BofE to have to raise interest rates so high. But then they have to look after their sponsors. They created this because people like you wanted the government to pay people to stay at home rather than work. This is the cost of Covid - very high public spending. The risk of inflation was well known 3 years ago. The BoE acted late on this. Have a read of this, this was written in 2021. www.briefingsforbritain.co.uk/inflation-the-main-threat-to-uk-economic-recovery/Note part 2: "Lax Monetary Policy Threatens to Derail the Recovery" Bollox. The cost of living crises is caused by rising gas and food prices due to a war in Ukraine. The price hikes pushed up inflation which this government did nothing about. That lead to wages rises in the region of 12-14% which solidified inflation. In all that time the government did sod all, but then that's standard for tis bunch of lying losers. |

|

|

|

Post by buccaneer on Jan 11, 2024 20:50:57 GMT

They created this because people like you wanted the government to pay people to stay at home rather than work. This is the cost of Covid - very high public spending. The risk of inflation was well known 3 years ago. The BoE acted late on this. Have a read of this, this was written in 2021. www.briefingsforbritain.co.uk/inflation-the-main-threat-to-uk-economic-recovery/Note part 2: "Lax Monetary Policy Threatens to Derail the Recovery" Bollox. The cost of living crises is caused by rising gas and food prices due to a war in Ukraine. The price hikes pushed up inflation which this government did nothing about. That lead to wages rises in the region of 12-14% which solidified inflation. In all that time the government did sod all, but then that's standard for tis bunch of lying losers. So, Covid has had no impact on inflation. Lol! |

|

|

|

Post by zanygame on Jan 11, 2024 21:01:01 GMT

Bollox. The cost of living crises is caused by rising gas and food prices due to a war in Ukraine. The price hikes pushed up inflation which this government did nothing about. That lead to wages rises in the region of 12-14% which solidified inflation. In all that time the government did sod all, but then that's standard for tis bunch of lying losers. So, Covid has had no impact on inflation. Lol! Not much. After Covid many people had savings which they spent, but that just resurrected businesses that had nothing left. |

|

|

|

Post by Pacifico on Jan 11, 2024 22:37:20 GMT

The only tax that would achieve the same effect is a rise in VAT. If by raising interest rates you are trying to reduce demand then to replicate that effect you need to increase a tax that has a direct correlation with the level of demand. The nonsense that we get from certain posters that all you need to do is tax the rich would achieve nothing as they contribute a miniscule amount to total demand in the economy - they are more likely to reduce saving and thus demand remains unchanged. So higher interest rates or higher VAT - your choice Again, your response is ideologically driven, an assumption that any tax on income is worse than anything else, and particularly so if the rich have to pay it. The suggestion is not exclusively to make the rich alone pay, as you seem to be trying to imply, which would clearly not work as a means to reduce demand across the board and thereby reduce inflation. It would be to reduce the spending power of all earners in direct proportion to how much they earn, reducing the spending power of everyone except those already too poor to spend much. The rich would only pay the same percentage as all other earners. Raising tax rates as a substitute for raising interest rates only works if you raise taxes across the entire spectrum of the economy. From your reaction to the suggestion of raising VAT I don't believe for a minute that you are supporting raising Income Taxes for those earning £20k - you are simply falling back on this tax the rich mantra. well lets be honest - are you suggesting taking money out of peoples pockets across the income spectrum?. |

|