|

|

Post by Pacifico on Jan 11, 2024 22:38:56 GMT

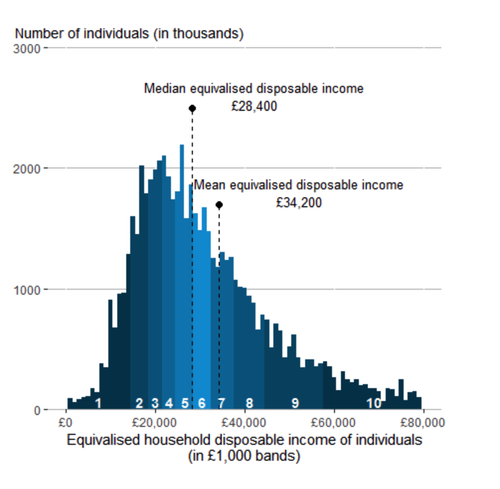

As I said - the tedious tax the rich idea will not work as there simply is not enough of them to influence demand in the entire economy.  What's that supposed to show me? 34% of households earn in excess of 50k a year. 34% of households do not determine the inflation rate - how many times..  |

|

|

|

Post by zanygame on Jan 11, 2024 22:54:23 GMT

Again, your response is ideologically driven, an assumption that any tax on income is worse than anything else, and particularly so if the rich have to pay it. The suggestion is not exclusively to make the rich alone pay, as you seem to be trying to imply, which would clearly not work as a means to reduce demand across the board and thereby reduce inflation. It would be to reduce the spending power of all earners in direct proportion to how much they earn, reducing the spending power of everyone except those already too poor to spend much. The rich would only pay the same percentage as all other earners. It only works if you raise taxes on those with money to spend. I am supporting raising income tax to 35% across the board. well lets be honest - are you suggesting taking money out of peoples pockets across the income spectrum?. |

|

|

|

Post by zanygame on Jan 11, 2024 22:56:07 GMT

What's that supposed to show me? 34% of households earn in excess of 50k a year. 34% of households do not determine the inflation rate - how many times..  Your evidence of that, or are you god? 37% of people have mortgages and that seems to be enough. |

|

|

|

Post by Pacifico on Jan 11, 2024 23:01:19 GMT

34% of households do not determine the inflation rate - how many times..  Your evidence of that, or are you god? 37% of people have mortgages and that seems to be enough. enough for what? Rampant demand led inflation is never going to be cured by clamping down on the cohort who are not responsible for the majority of the demand. The idea that only the rich are responsible for inflation is 'interesting' - I'm not convinced it's that economically coherent though... |

|

|

|

Post by zanygame on Jan 11, 2024 23:28:10 GMT

Your evidence of that, or are you god? 37% of people have mortgages and that seems to be enough. enough for what? Rampant demand led inflation is never going to be cured by clamping down on the cohort who are not responsible for the majority of the demand. The idea that only the rich are responsible for inflation is 'interesting' - I'm not convinced it's that economically coherent though... That's the second time you've misrepresented me. I have said all tax up to 35% Not just the rich. If increasing interest on mortgage payers is enough to alter spending patterns, then so is increasing income tax. Is your job to trawl the internet stopping anyone questioning the rich? |

|

|

|

Post by Pacifico on Jan 12, 2024 7:51:04 GMT

enough for what? Rampant demand led inflation is never going to be cured by clamping down on the cohort who are not responsible for the majority of the demand. The idea that only the rich are responsible for inflation is 'interesting' - I'm not convinced it's that economically coherent though... That's the second time you've misrepresented me. I have said all tax up to 35% Not just the rich. If increasing interest on mortgage payers is enough to alter spending patterns, then so is increasing income tax. Is your job to trawl the internet stopping anyone questioning the rich? So if you are proposing increasing Income taxes for those on £20k how does that square with your demand for cheaper fuel and food prices for those on lower pay? You giving with one hand and taking away with the other - it is not going to achieve much is it. |

|

|

|

Post by oracle75 on Jan 12, 2024 8:03:27 GMT

Interest rate hikes encourage saving, therefore keeping money in people's pockets. For too long the credit card has been forefront of public spending. It is not a very good way of buying. Living within your means is better. I am afraid keeping money in your pocket instead of paying a larger mortgage due to higher interest rates will get you into serious trouble. They also deter requests for loans by business wanting to expand. |

|

|

|

Post by zanygame on Jan 12, 2024 8:17:03 GMT

That's the second time you've misrepresented me. I have said all tax up to 35% Not just the rich. If increasing interest on mortgage payers is enough to alter spending patterns, then so is increasing income tax. Is your job to trawl the internet stopping anyone questioning the rich? So if you are proposing increasing Income taxes for those on £20k how does that square with your demand for cheaper fuel and food prices for those on lower pay? You giving with one hand and taking away with the other - it is not going to achieve much is it. Simple. The tax is proportional to earnings. Mortgage interest rates are not. Landlords would not see mortgage hikes either and would not need to pass these onto renters. |

|

|

|

Post by jonksy on Jan 12, 2024 8:18:59 GMT

Interest rate hikes encourage saving, therefore keeping money in people's pockets. For too long the credit card has been forefront of public spending. It is not a very good way of buying. Living within your means is better. I am afraid keeping money in your pocket instead of paying a larger mortgage due to higher interest rates will get you into serious trouble. They also deter requests for loans by business wanting to expand.Dyson criticises ‘perverse’ ruling after losing £150m battle with Brussels......

|

|

|

|

Post by zanygame on Jan 12, 2024 8:20:52 GMT

Interest rate hikes encourage saving, therefore keeping money in people's pockets. For too long the credit card has been forefront of public spending. It is not a very good way of buying. Living within your means is better. How? Au contraire. When interest rates are low those with money look to invest in entrepreneurs to get a better return. |

|

|

|

Post by zanygame on Jan 12, 2024 8:26:45 GMT

I am afraid keeping money in your pocket instead of paying a larger mortgage due to higher interest rates will get you into serious trouble. They also deter requests for loans by business wanting to expand.Dyson criticises ‘perverse’ ruling after losing £150m battle with Brussels......

Is that Malaysian Dyson, Chinese Dyson or Filipino Dyson? |

|

|

|

Post by Pacifico on Jan 12, 2024 8:32:03 GMT

Dyson criticises ‘perverse’ ruling after losing £150m battle with Brussels......

Is that Malaysian Dyson, Chinese Dyson or Filipino Dyson? he is a UK resident |

|

|

|

Post by jonksy on Jan 12, 2024 8:32:04 GMT

Dyson criticises ‘perverse’ ruling after losing £150m battle with Brussels......

Is that Malaysian Dyson, Chinese Dyson or Filipino Dyson? Read the link yourself zany. |

|

|

|

Post by oracle75 on Jan 12, 2024 8:33:50 GMT

How? Au contraire. When interest rates are low those with money look to invest in entrepreneurs to get a better return. We were discussing raising interest rates. When interest rates go up in order to control spending, all it does is divert that spending to banks via higher mortgage /loan payments. A lesson Liz Truss should have known about. And high interest rates mean more expensive loans so companies seeking to invest and grow go somewhere else where interest rates are lower. Fundamental economics. |

|

|

|

Post by oracle75 on Jan 12, 2024 8:38:22 GMT

I am afraid keeping money in your pocket instead of paying a larger mortgage due to higher interest rates will get you into serious trouble. They also deter requests for loans by business wanting to expand.Dyson criticises ‘perverse’ ruling after losing £150m battle with Brussels......

Your link has absolutely nothing to do with interest rates. |

|