Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Oct 31, 2024 8:53:17 GMT

I have spent the last five years telling anyone who would listen that Starmer is a liar. I said he had a track record of lying to electorates then breaking his promises once in place. He did that to Labour Party members to get elected leader. I pointed out that anyone who could so blatantly lie to us, the then party members, was equally capable of lying to the wider electorate then breaking his promises once in office. And so it is proving. As for the budget itself, I believe there is more good than bad in it and it is better than most Tory budgets, and am pleased that fuel duty has not been increased. But this post would be so long that no one would read it if I broke it all down point by point. Ref the budget; whether it's seen as good or bad is personal I suppose, it's certainly not going to adversely affect me. But I'm listening to far wiser people than me who say it's not a budget for growth, even Labour commentators are sheepishly conceding the point and saying it's a low growth budget, and without growth the economy will not grow and if the economy doesn't grow then what... borrow more? The long term economic forecast for this typically socialist budget, does not bode well. Well like many others I was convinced that there was going to be a big fuel duty increase which would of course have hit many working people. So I was very pleasantly surprised and indeed pleased that she did not do that for precisely the reasons I stated, that it would have hurt millions of working people. The big minimum wage increase was welcome to me since the new rate would be nearly 20p an hour more than my current hourly rate, and my employers' desire to not be known as a minimum wage employer has thus far always resulted in a pay award that lifts us well above the minimum. No guarantee of that latter continuing but Tesco very much does not want to be known as just another minimum wage employer, so I have good hopes that the minimum wage increase will have a beneficial knock on on my pay. The continued freeze on tax thresholds hits me hard though, because it guarantees that I pay full tax on every pound of any increase. So any pay rise I get the government takes 28 percent of. They made a virtue out of the fact that they were not going to extend the threshold freeze beyond 2028 as the Tories planned to to. But that is still four years threshold freezes to come. And the cynic in me immediately notices that the threshold freeze ceases just in time for the next election, and not before. This freeze of course hurts working people of two main types. The low paid, ever larger numbers of whom will be seeing a greater proportion of their incomes becoming taxable. And those on middling salaries who will increasingly be seeing themselves paying a growing part of their incomes at the higher rate. As someone with a host of medical conditions, the extra NHS funding is of course welcome, but since I am struggling with work so much more than I once did, and the days in which I am going to be able to continue working are numbered, I do have concerns about the future of sickness benefits. I am after all still 7 years and 8 months away from a state pension. And the goalposts have been shifted for me since I left school expecting to retire at 65 and now that age has been raised to 67. I gave up smoking 20 years ago so taxes on tobacco do not impact me at all, and I do not drink much alcohol. But with wry amusement I note the fact that when a pint now costs typically over a fiver, reducing the cost by 1p is a bit like pissing in the Atlantic and expecting it to make a difference, lol. And will in any case be entirely undone by the big increase in the minimum wage and in employers' NI contributions insofar as running costs are concerned. So that is effectively little more than a headline grabbing gimmick. If anyone actually notices the pint in their local being a penny cheaper than yesterday, please do give us the good news. I will be surprised if it happens anywhere. |

|

|

|

Post by jonksy on Oct 31, 2024 9:22:48 GMT

Ref the budget; whether it's seen as good or bad is personal I suppose, it's certainly not going to adversely affect me. But I'm listening to far wiser people than me who say it's not a budget for growth, even Labour commentators are sheepishly conceding the point and saying it's a low growth budget, and without growth the economy will not grow and if the economy doesn't grow then what... borrow more? The long term economic forecast for this typically socialist budget, does not bode well. Well like many others I was convinced that there was going to be a big fuel duty increase which would of course have hit many working people. So I was very pleasantly surprised and indeed pleased that she did not do that for precisely the reasons I stated, that it would have hurt millions of working people. The big minimum wage increase was welcome to me since the new rate would be nearly 20p an hour more than my current hourly rate, and my employers' desire to not be known as a minimum wage employer has thus far always resulted in a pay award that lifts us well above the minimum. No guarantee of that latter continuing but Tesco very much does not want to be known as just another minimum wage employer, so I have good hopes that the minimum wage increase will have a beneficial knock on on my pay. The continued freeze on tax thresholds hits me hard though, because it guarantees that I pay full tax on every pound of any increase. So any pay rise I get the government takes 28 percent of. They made a virtue out of the fact that they were not going to extend the threshold freeze beyond 2028 as the Tories planned to to. But that is still four years threshold freezes to come. And the cynic in me immediately notices that the threshold freeze ceases just in time for the next election, and not before. This freeze of course hurts working people of two main types. The low paid, ever larger numbers of whom will be seeing a greater proportion of their incomes becoming taxable. And those on middling salaries who will increasingly be seeing themselves paying a growing part of their incomes at the higher rate. As someone with a host of medical conditions, the extra NHS funding is of course welcome, but since I am struggling with work so much more than I once did, and the days in which I am going to be able to continue working are numbered, I do have concerns about the future of sickness benefits. I am after all still 7 years and 8 months away from a state pension. And the goalposts have been shifted for me since I left school expecting to retire at 65 and now that age has been raised to 67. I gave up smoking 20 years ago so taxes on tobacco do not impact me at all, and I do not drink much alcohol. But with wry amusement I note the fact that when a pint now costs typically over a fiver, reducing the cost by 1p is a bit like pissing in the Atlantic and expecting it to make a difference, lol. And will in any case be entirely undone by the big increase in the minimum wage and in employers' NI contributions insofar as running costs are concerned. So that is effectively little more than a headline grabbing gimmick. If anyone actually notices the pint in their local being a penny cheaper than yesterday, please do give us the good news. I will be surprised if it happens anywhere. Anyone who smokes buy their baccy from under the shelf....I pay £20 for a pack that would be more than double that from a normal outlet.. Just another part of the growing black economy... |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Oct 31, 2024 9:57:00 GMT

Well like many others I was convinced that there was going to be a big fuel duty increase which would of course have hit many working people. So I was very pleasantly surprised and indeed pleased that she did not do that for precisely the reasons I stated, that it would have hurt millions of working people. The big minimum wage increase was welcome to me since the new rate would be nearly 20p an hour more than my current hourly rate, and my employers' desire to not be known as a minimum wage employer has thus far always resulted in a pay award that lifts us well above the minimum. No guarantee of that latter continuing but Tesco very much does not want to be known as just another minimum wage employer, so I have good hopes that the minimum wage increase will have a beneficial knock on on my pay. The continued freeze on tax thresholds hits me hard though, because it guarantees that I pay full tax on every pound of any increase. So any pay rise I get the government takes 28 percent of. They made a virtue out of the fact that they were not going to extend the threshold freeze beyond 2028 as the Tories planned to to. But that is still four years threshold freezes to come. And the cynic in me immediately notices that the threshold freeze ceases just in time for the next election, and not before. This freeze of course hurts working people of two main types. The low paid, ever larger numbers of whom will be seeing a greater proportion of their incomes becoming taxable. And those on middling salaries who will increasingly be seeing themselves paying a growing part of their incomes at the higher rate. As someone with a host of medical conditions, the extra NHS funding is of course welcome, but since I am struggling with work so much more than I once did, and the days in which I am going to be able to continue working are numbered, I do have concerns about the future of sickness benefits. I am after all still 7 years and 8 months away from a state pension. And the goalposts have been shifted for me since I left school expecting to retire at 65 and now that age has been raised to 67. I gave up smoking 20 years ago so taxes on tobacco do not impact me at all, and I do not drink much alcohol. But with wry amusement I note the fact that when a pint now costs typically over a fiver, reducing the cost by 1p is a bit like pissing in the Atlantic and expecting it to make a difference, lol. And will in any case be entirely undone by the big increase in the minimum wage and in employers' NI contributions insofar as running costs are concerned. So that is effectively little more than a headline grabbing gimmick. If anyone actually notices the pint in their local being a penny cheaper than yesterday, please do give us the good news. I will be surprised if it happens anywhere. Anyone who smokes buy their baccy from under the shelf....I pay £20 for a pack that would be more than double that from a normal outlet.. Just another part of the growing black economy... Yes, even 20 years ago before I gave up I was buying bootleg tobacco. I can understand them using tax to make nicotine ever more expensive to discourage people from smoking because smoking is very bad for people. But there is an optimum level at which doing this is viable. Make prices too artificially high and you create the ideal conditions for a smuggling operation and black market to flourish, resulting in more smokers funding criminals and less taxes going to the government. We have long since passed that point. Mind you, in my job I sometimes work in the garage kiosk and the legitimate price of tobacco and cigarettes is eye-watering. I am astonished by how many people still pay it. No way could I afford to smoke today. Even if illicit supplies were only half as much in price it would still be a huge expense. Poor people who still smoke are idiots. It is highly likely to be being paid for by feeding their kids the cheapest and unhealthiest shit. |

|

|

|

Post by ratcliff on Oct 31, 2024 10:11:39 GMT

Bad news for businesses. To stimulate growth, you reduce tax, not increase it. NI and minimum wage, more full time roles will just be replaced with part timers to avoid the NI cost, plus, less jobs in general. Then prices will have to increase. In the end, Joe Public suffers. I forsee high street shop closures accelerating. Everyone wants everything for nothing, high street businesses will suffer. Well most businesses are of course not going to be able to just absorb the increased NI burden without in some way adjusting downwards their operating costs or upwards their income streams. These costs will therefore be borne by lower pay rises for employees, lower recruitment levels, or higher prices for consumers, or some combination thereof. There is no such thing as a tax raid on businesses that does not impact upon the rest of us, at least indirectly. That said, with underpaid public sector workers increasingly walking away, public services barely functional, there was a chronic need for more public investment and this does not come without costs. The big three tax revenue streams are VAT, Income Tax and NI. It is difficult to raise large extra sums without using at least one of these, so targeting employers from Labour's perspective looks like the least bad option. Any hit to workers from doing this will be a lot less obvious on their pay slips than if employees NI had been increased. In other words, though working people will still be paying the price in the long run, Labour are banking on many more of them not actually noticing. Typical Labour centrist cynicism. But since the money had to be raised somehow, how else could the £25 billion resulting from this increase have been raised? What alternatives were there? And any suggestions that giving the poor a damned good kicking instead - especially the working ones - would not be persuasive, as this would do more harm than the NI increase is likely to do to those least able to afford it. In my view there was certainly more scope for wealth taxes on the super rich, particularly on immoveable assets like property or land which cannot be shifted abroad or physically hidden. This might have raised a few billion but nowhere near the £25 billion level. So what other alternatives could there have been? A land value tax might well have raised some of it. There was definitely scope for windfall taxes in a few areas but such taxes are one offs by their nature and best used to fund one off expenditures, eg post office scandal compensation. Or one off infrastructure expenditures. That sort of thing. Taxing dividend income at the same rate as taxes on earned incomes would have raised a bit. Because there is a loophole there that can readily be exploited. I know someone who a few years back earned a six figure sum from her own business. But she paid herself minimum wage and took most of her income in the form of a dividend, thereby paying much less tax than you or I would if we had a similar but salaried income. Had some of these things been done, we could at least have hit employers less hard with NI contributions, by raising some of the monies required in these other ways.

Underpaid? Are you going for C2s mantel as the most non economically competent poster to give us a laugh at their abject financial naivety ? Train drivers on £60k for a 4 day week have just had a backdated £10k rise taking them to av £70k for a 4 day week and no concessions whatsoever on Spanish practices Junior doctors a 22% rise with no promise of working strike free Nurses still arguing about the mega pay rise they were offered Others a £300 daily bonus just for turning up Civil servants refusing to go into work and still collecting their (eg) London weighting allowances Gold plated pensions denied to those in the private sector 314 public new public sector jobs created every day Public sector productivity constantly falling - it's virually wholly unproductive etc etc etc Public sector spending should be severely curtailed - not increased The 2% ''saving'' Robber Reeves announced probably wouldn't even pay for teabags Government spending should be cut immediately by a minimum of 25% with the aim of a 50% cut over the life of this Parliament |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Oct 31, 2024 10:28:49 GMT

Well most businesses are of course not going to be able to just absorb the increased NI burden without in some way adjusting downwards their operating costs or upwards their income streams. These costs will therefore be borne by lower pay rises for employees, lower recruitment levels, or higher prices for consumers, or some combination thereof. There is no such thing as a tax raid on businesses that does not impact upon the rest of us, at least indirectly. That said, with underpaid public sector workers increasingly walking away, public services barely functional, there was a chronic need for more public investment and this does not come without costs. The big three tax revenue streams are VAT, Income Tax and NI. It is difficult to raise large extra sums without using at least one of these, so targeting employers from Labour's perspective looks like the least bad option. Any hit to workers from doing this will be a lot less obvious on their pay slips than if employees NI had been increased. In other words, though working people will still be paying the price in the long run, Labour are banking on many more of them not actually noticing. Typical Labour centrist cynicism. But since the money had to be raised somehow, how else could the £25 billion resulting from this increase have been raised? What alternatives were there? And any suggestions that giving the poor a damned good kicking instead - especially the working ones - would not be persuasive, as this would do more harm than the NI increase is likely to do to those least able to afford it. In my view there was certainly more scope for wealth taxes on the super rich, particularly on immoveable assets like property or land which cannot be shifted abroad or physically hidden. This might have raised a few billion but nowhere near the £25 billion level. So what other alternatives could there have been? A land value tax might well have raised some of it. There was definitely scope for windfall taxes in a few areas but such taxes are one offs by their nature and best used to fund one off expenditures, eg post office scandal compensation. Or one off infrastructure expenditures. That sort of thing. Taxing dividend income at the same rate as taxes on earned incomes would have raised a bit. Because there is a loophole there that can readily be exploited. I know someone who a few years back earned a six figure sum from her own business. But she paid herself minimum wage and took most of her income in the form of a dividend, thereby paying much less tax than you or I would if we had a similar but salaried income. Had some of these things been done, we could at least have hit employers less hard with NI contributions, by raising some of the monies required in these other ways.

Underoaid? Are you going for C2s mantel as the most non economically competent poster to give us a laugh at their abject financial naivety ? Train drivers on £60k for a 4 day week have just had a backdated £10k rise taking them to av £70k for a 4 day week and no concessions whatsoever on Spanish practices Junior doctors a 22% rise with no promise of working strike free Nurses still arguing about the mega pay rise they were offered Others a £300 daily bonus just for turning up Civil servants refusing to go into work and still collecting their (eg) London weighting allowances Gold plated pensions denied to those in the private sector 314 public new public sector jobs created every day Public sector productivity constantly falling - it's virually wholly unproductive etc etc etc Public sector spending should be severely curtailed - not increased The 2% ''saving'' Robber Reeves announced probably wouldn't even pay for teabags Government spending should be cut immediately by a minimum of 25% with the aim of a 50% cut over the life of this Parliament Most train drivers are not public sector workers. And yes some public sector workers higher up the scale - hospital consultants for example - are still relatively well paid. But many are not. And even those who are have seen real terms reductions in their pay which makes it less competitive in comparison to more lucrative offers elsewhere. The NHS in particular has been suffering from a severe recruitment and retention crisis which was approaching crisis point. And to a lesser extent other sectors have been too, eg schools and the civil service. One of my best friends works for the DWP and she has told me that the brightest and the best, unless promptly promoted as she has been lucky enough to have been, have been leaving in ever greater numbers, whilst the quality of many new applicants has sharply declined and they are struggling to recruit people of a sufficiently high calibre much more than they used to, and making do with poorer quality recruits because they have to. This is telling in the fact that the DWP is now losing five times more money as a result of errors than they are in actual fraud. Another friend works for the probation service and that is utterly on its knees. You cant keep imposing year on year real terms pay cuts without creating such problems eventually, at least not for jobs requiring some level of professional experience as many public sector roles do.. Reversing direction was a financial and social necessity. Because had we continued the way we were going, we'd have been hit with far higher social and financial costs before too long. |

|

|

|

Post by The Squeezed Middle on Oct 31, 2024 10:31:13 GMT

Well most businesses are of course not going to be able to just absorb the increased NI burden without in some way adjusting downwards their operating costs or upwards their income streams. These costs will therefore be borne by lower pay rises for employees, lower recruitment levels, or higher prices for consumers, or some combination thereof. There is no such thing as a tax raid on businesses that does not impact upon the rest of us, at least indirectly. That said, with underpaid public sector workers increasingly walking away, public services barely functional, there was a chronic need for more public investment and this does not come without costs. The big three tax revenue streams are VAT, Income Tax and NI. It is difficult to raise large extra sums without using at least one of these, so targeting employers from Labour's perspective looks like the least bad option. Any hit to workers from doing this will be a lot less obvious on their pay slips than if employees NI had been increased. In other words, though working people will still be paying the price in the long run, Labour are banking on many more of them not actually noticing. Typical Labour centrist cynicism. But since the money had to be raised somehow, how else could the £25 billion resulting from this increase have been raised? What alternatives were there? And any suggestions that giving the poor a damned good kicking instead - especially the working ones - would not be persuasive, as this would do more harm than the NI increase is likely to do to those least able to afford it. In my view there was certainly more scope for wealth taxes on the super rich, particularly on immoveable assets like property or land which cannot be shifted abroad or physically hidden. This might have raised a few billion but nowhere near the £25 billion level. So what other alternatives could there have been? A land value tax might well have raised some of it. There was definitely scope for windfall taxes in a few areas but such taxes are one offs by their nature and best used to fund one off expenditures, eg post office scandal compensation. Or one off infrastructure expenditures. That sort of thing. Taxing dividend income at the same rate as taxes on earned incomes would have raised a bit. Because there is a loophole there that can readily be exploited. I know someone who a few years back earned a six figure sum from her own business. But she paid herself minimum wage and took most of her income in the form of a dividend, thereby paying much less tax than you or I would if we had a similar but salaried income. Had some of these things been done, we could at least have hit employers less hard with NI contributions, by raising some of the monies required in these other ways.

Underpaid? Are you going for C2s mantel as the most non economically competent poster to give us a laugh at their abject financial naivety ? Train drivers on £60k for a 4 day week have just had a backdated £10k rise taking them to av £70k for a 4 day week and no concessions whatsoever on Spanish practices Junior doctors a 22% rise with no promise of working strike free Nurses still arguing about the mega pay rise they were offered Others a £300 daily bonus just for turning up Civil servants refusing to go into work and still collecting their (eg) London weighting allowances Gold plated pensions denied to those in the private sector 314 public new public sector jobs created every day Public sector productivity constantly falling - it's virually wholly unproductive etc etc etc Public sector spending should be severely curtailed - not increased The 2% ''saving'' Robber Reeves announced probably wouldn't even pay for teabags Government spending should be cut immediately by a minimum of 25% with the aim of a 50% cut over the life of this Parliament But you are ignoring the vast swathes of the public sector, me included, that endured a 10 year pay freeze. When I left my last job, I was earning 20% less in real terms than I was when I started. Which is why important sections of the public sector have a recruitment crisis. |

|

|

|

Post by The Squeezed Middle on Oct 31, 2024 10:35:43 GMT

Anyways, back to the plot: The budget will raise prices and increase inflation & unemployment.

|

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Oct 31, 2024 10:38:51 GMT

For those who think public sector workers are brilliantly paid, my friend started out in the DWP on an hourly rate less than a couple of quid higher than that which a Tesco shelf stacker gets. That she gets more than that now is due to her seeking and gaining promotion. And supposedly gold plated pensions are not set in stone if you have many working age decades left. Goalposts can be moved in that time. And the average 20 something is far more concerned about pay now than a decent pension in what seems to them still like a distant future.

|

|

|

|

Post by Pacifico on Oct 31, 2024 11:46:36 GMT

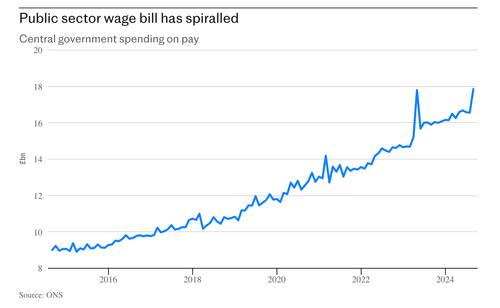

You can make the argument either way over whether Public Sector workers are well paid for what they do or not, but it's undeniable that there are far too many of them.  |

|

|

|

Post by The Squeezed Middle on Oct 31, 2024 12:34:15 GMT

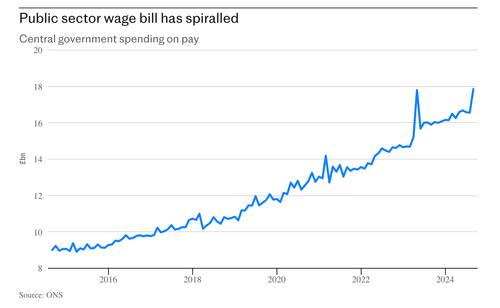

You can make the argument either way over whether Public Sector workers are well paid for what they do or not, but it's undeniable that there are far too many of them.  Possibly. But as usual it comes down to efficient use of resources: There may be "Too many" overall but there are plenty of departments with too few where it matters. |

|

|

|

Post by johnofgwent on Oct 31, 2024 13:03:03 GMT

Anyways, back to the plot: The budget will raise prices and increase inflation & unemployment. Absolutely Three days ago the censor scum at the BBC removed my have your say comment that an NI hike for employers and a massive hike in NMW means ONLY those on NMW will get a pay rise next year as 'misleading, offensive, racist or homophobic' Yet here we are today with the fustercluckers posting the bitch from number 11's admission it will do just that. Also I really must hope next Wednesday's biopsy is the worst news going, as otherwise my unspent pension will be slapped for a 40% grab by HMRC if I live to age 70 |

|

|

|

Post by ratcliff on Oct 31, 2024 13:28:18 GMT

That said, with underpaid public sector workers increasingly walking away, public services barely functional, there was a chronic need for more public investment and this does not come without costs.

Underoaid? Are you going for C2s mantel as the most non economically competent poster to give us a laugh at their abject financial naivety ? Train drivers on £60k for a 4 day week have just had a backdated £10k rise taking them to av £70k for a 4 day week and no concessions whatsoever on Spanish practices Junior doctors a 22% rise with no promise of working strike free Nurses still arguing about the mega pay rise they were offered Others a £300 daily bonus just for turning up Civil servants refusing to go into work and still collecting their (eg) London weighting allowances Gold plated pensions denied to those in the private sector 314 public new public sector jobs created every day Public sector productivity constantly falling - it's virually wholly unproductive etc etc etc Public sector spending should be severely curtailed - not increased The 2% ''saving'' Robber Reeves announced probably wouldn't even pay for teabags Government spending should be cut immediately by a minimum of 25% with the aim of a 50% cut over the life of this Parliament Most train drivers are not public sector workers. And yes some public sector workers higher up the scale - hospital consultants for example - are still relatively well paid. But many are not. And even those who are have seen real terms reductions in their pay which makes it less competitive in comparison to more lucrative offers elsewhere. The NHS in particular has been suffering from a severe recruitment and retention crisis which was approaching crisis point. And to a lesser extent other sectors have been too, eg schools and the civil service. One of my best friends works for the DWP and she has told me that the brightest and the best, unless promptly promoted as she has been lucky enough to have been, have been leaving in ever greater numbers, whilst the quality of many new applicants has sharply declined and they are struggling to recruit people of a sufficiently high calibre much more than they used to, and making do with poorer quality recruits because they have to. This is telling in the fact that the DWP is now losing five times more money as a result of errors than they are in actual fraud. Another friend works for the probation service and that is utterly on its knees. You cant keep imposing year on year real terms pay cuts without creating such problems eventually, at least not for jobs requiring some level of professional experience as many public sector roles do.. Reversing direction was a financial and social necessity. Because had we continued the way we were going, we'd have been hit with far higher social and financial costs before too long. Fire a third of all public sector workers and make the rest actually work - not shirk as at present Public sector productivity might then increase |

|

|

|

Post by ratcliff on Oct 31, 2024 13:29:47 GMT

For those who think public sector workers are brilliantly paid, my friend started out in the DWP on an hourly rate less than a couple of quid higher than that which a Tesco shelf stacker gets. That she gets more than that now is due to her seeking and gaining promotion. And supposedly gold plated pensions are not set in stone if you have many working age decades left. Goalposts can be moved in that time. And the average 20 something is far more concerned about pay now than a decent pension in what seems to them still like a distant future. The Tesco worker has to work and produce a tangible result unlike public sector workers |

|

|

|

Post by The Squeezed Middle on Oct 31, 2024 16:10:40 GMT

Most train drivers are not public sector workers. And yes some public sector workers higher up the scale - hospital consultants for example - are still relatively well paid. But many are not. And even those who are have seen real terms reductions in their pay which makes it less competitive in comparison to more lucrative offers elsewhere. The NHS in particular has been suffering from a severe recruitment and retention crisis which was approaching crisis point. And to a lesser extent other sectors have been too, eg schools and the civil service. One of my best friends works for the DWP and she has told me that the brightest and the best, unless promptly promoted as she has been lucky enough to have been, have been leaving in ever greater numbers, whilst the quality of many new applicants has sharply declined and they are struggling to recruit people of a sufficiently high calibre much more than they used to, and making do with poorer quality recruits because they have to. This is telling in the fact that the DWP is now losing five times more money as a result of errors than they are in actual fraud. Another friend works for the probation service and that is utterly on its knees. You cant keep imposing year on year real terms pay cuts without creating such problems eventually, at least not for jobs requiring some level of professional experience as many public sector roles do.. Reversing direction was a financial and social necessity. Because had we continued the way we were going, we'd have been hit with far higher social and financial costs before too long. Fire a third of all public sector workers and make the rest actually work - not shirk as at present Public sector productivity might then increase I do plenty of work, thanks. |

|

|

|

Post by The Squeezed Middle on Oct 31, 2024 16:11:01 GMT

For those who think public sector workers are brilliantly paid, my friend started out in the DWP on an hourly rate less than a couple of quid higher than that which a Tesco shelf stacker gets. That she gets more than that now is due to her seeking and gaining promotion. And supposedly gold plated pensions are not set in stone if you have many working age decades left. Goalposts can be moved in that time. And the average 20 something is far more concerned about pay now than a decent pension in what seems to them still like a distant future. The Tesco worker has to work and produce a tangible result unlike public sector workers Bollocks. |

|