|

|

Post by The Squeezed Middle on Jul 27, 2023 9:14:36 GMT

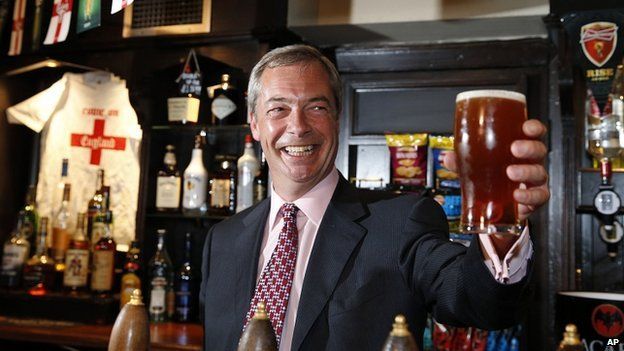

They do now that Nigel's drawing attention to it.

It's going to be his next campaign.🙂

|

|

|

|

Post by Fairsociety on Jul 27, 2023 9:20:11 GMT

They must be dizzy by now!🤣 Zany is confident enough to say he is wrong when facts appear. Though in this case Zany never said it was not political, all he said was we don't know and this is what the bank is saying.

Zany's slant on this was that thousands of poor people lose their bank accounts every year and no one gives a flying f**k. Do they?

Got any link to back that up?

|

|

|

|

Post by buccaneer on Jul 27, 2023 9:24:25 GMT

Jeremy Warner a remainer and columnist in the Telegraph believes this is another monumental fuck-up from the remainer elite who like some of our posters on here haven't gotten over Brexit. Their bitterness over Brexit (of course Farage's views on that don't align with theirs), can lead people to reasonably assume that these corporate establishment types will go to such lengths to de-bank people; especially when as Warner says Brexit was referenced a number of times in their dossier. Sprinkle the colourful alphabet community on top of your elitist values and you have a real melting pot of authoritarianism, censorship and intolerance. And the irony in all this is that it was Farage who inadvertently outed the bitter and bigoted corporate elite. Cheers Nigel.  |

|

|

|

Post by Einhorn on Jul 27, 2023 9:38:19 GMT

You're right, Sheeps - something needs to be done about those communist banks. |

|

|

|

Post by Orac on Jul 27, 2023 9:39:48 GMT

When this episode began, it was perhaps reasonable to consider the bank's decision either (likely) politically motivated, or (likely) not. My feeling from the start was that the bank's actions were likely politically motivated, but I could see why someone might claim that this position may be (at the time and strictly speaking) unwarranted.

However, as events unfolded, including revelation of the bank's - frankly bizarre - internal communications, holding the latter position in preference to the former required increasing levels of 'tenacity' or dishonesty. Unless you are full on psychopath, there will be a breaking point where the dishonesty you have to employ becomes too distasteful. There are some tests it's better to fail at.

|

|

|

|

Post by zanygame on Jul 27, 2023 9:53:19 GMT

|

|

|

|

Post by Fairsociety on Jul 27, 2023 9:58:15 GMT

Zany is confident enough to say he is wrong when facts appear. Though in this case Zany never said it was not political, all he said was we don't know and this is what the bank is saying.

Zany's slant on this was that thousands of poor people lose their bank accounts every year and no one gives a flying f**k. Do they?

Got any link to back that up?

It doesn't mention 'thousands of poor people lose their bank accounts every year', you just made that up for impact. |

|

|

|

Post by Einhorn on Jul 27, 2023 10:06:52 GMT

lolz...

The left narrative evolution on Farage debanking has been amazing to watch:

From

- "This isn't political! Just banks following banking regulations"

To

- "LOL, Farage is too poor"

To

- "OK, it was political but it's fine because Farage is evil"

To..

"Yes, they shouldn't have lied about him to the BBC..."

To

- "The bank CEO who briefed lies to the media has now resigned. This is outrageous government interference in private business!!! The CEO is the real victim!"

Looking forward to the next pivot...

I think Monte, Darling & Zany made some of those pivots.  You can believe that Coutts management is motivated by philanthropic concerns if you like. Knock yourself out if you want to think that their board of directors was motivated by qualms of conscience or was suddenly overtaken by a desire to do God's work. The rest of us know that Coutts didn't give two shits about Farage's political views. We know this wasn't a political decision, it was a commercial decision. The manfrog was seen to be bad for the Coutts brand, so they got rid of him. If the manfrog had been widely popular with the kind of clientele they hope to attract, they would have welcomed him with open arms. Profit, not political belief, was the driving force behind Coutts' decision to rid itself of the manfrog. |

|

|

|

Post by The Squeezed Middle on Jul 27, 2023 10:08:29 GMT

...Brexit was referenced a number of times in their dossier. Sprinkle the colourful alphabet community on top of your elitist values and you have a real melting pot of authoritarianism, censorship and intolerance... Yes, it's a toxic blend of minority interests that the majority are supposed to endlessly accommodate. Or else. It's why I loathe the left - they're becoming more fascistic by the day. |

|

|

|

Post by buccaneer on Jul 27, 2023 10:10:40 GMT

I think Monte, Darling & Zany made some of those pivots.  You can believe that Coutts management is motivated by philanthropic concerns if you like. Knock yourself out if you want to think that their board of directors was motivated by qualms of conscience or was suddenly overtaken by a desire to do God's work. The rest of us know that Coutts didn't give two shits about Farage's political views. We know this wasn't a political decision, it was a commercial decision. The manfrog was seen to be bad for the Coutts brand, so they got rid of him. If the manfrog had been widely popular with the kind of clientele they hope to attract, they would have welcomed him with open arms. Is that your latest pivot! |

|

|

|

Post by Einhorn on Jul 27, 2023 10:12:25 GMT

You can believe that Coutts management is motivated by philanthropic concerns if you like. Knock yourself out if you want to think that their board of directors was motivated by qualms of conscience or was suddenly overtaken by a desire to do God's work. The rest of us know that Coutts didn't give two shits about Farage's political views. We know this wasn't a political decision, it was a commercial decision. The manfrog was seen to be bad for the Coutts brand, so they got rid of him. If the manfrog had been widely popular with the kind of clientele they hope to attract, they would have welcomed him with open arms. Is that your latest pivot! My third today, Bubs. I've another six planned for this afternoon. |

|

|

|

Post by buccaneer on Jul 27, 2023 10:13:23 GMT

Is that your latest pivot! My third today, Bubs. I've another six planned for this afternoon. One day, you may get something right. Until then, keep spinning Kylie. |

|

|

|

Post by Einhorn on Jul 27, 2023 10:14:18 GMT

My third today, Bubs. I've another six planned for this afternoon. One day, you may get something right. Until then, keep spinning Kylie. Enjoy your martyr complex, Bubs. |

|

|

|

Post by Fairsociety on Jul 27, 2023 10:22:01 GMT

Interesting..

In early 2018, the Royal Bank of Scotland Group (now NatWest Group) announced its plans for restructuring to comply with new UK-wide rules on ring-fencing retail banking operations from investment banking operations. As part of this restructuring, all retail banking assets of the Royal Bank of Scotland were transferred to Adam and Company, which was renamed Royal Bank of Scotland. Adam and Company continued as a private banking brand operating on the main PRA licence of RBS, where customers enjoyed privileged services such as relationship management and discounts on standard retail banking products but where FSCS protection for deposits and other regulatory matters were not distinct from those relating to high street banking customers.[4]

In 2022, RBS transferred the banking and lending business to Coutts & Co. using a banking business transfer scheme approved by the Court of Session in Edinburgh under Part VII of the Financial Services and Markets Act 2000.

|

|

|

|

Post by Einhorn on Jul 27, 2023 10:24:20 GMT

Interesting.. In early 2018, the Royal Bank of Scotland Group (now NatWest Group) announced its plans for restructuring to comply with new UK-wide rules on ring-fencing retail banking operations from investment banking operations. As part of this restructuring, all retail banking assets of the Royal Bank of Scotland were transferred to Adam and Company, which was renamed Royal Bank of Scotland. Adam and Company continued as a private banking brand operating on the main PRA licence of RBS, where customers enjoyed privileged services such as relationship management and discounts on standard retail banking products but where FSCS protection for deposits and other regulatory matters were not distinct from those relating to high street banking customers.[4] In 2022, RBS transferred the banking and lending business to Coutts & Co. using a banking business transfer scheme approved by the Court of Session in Edinburgh under Part VII of the Financial Services and Markets Act 2000. Breaking News: Bankers are Greedy Bastards. |

|