|

|

Post by see2 on Jan 27, 2023 22:48:45 GMT

He never took direct responsibility for the meltdown. Its time for you to stop waffling. Your last line is not a joke, it is a lie. He took responsibility for putting in place a banking regulation system that failed - had he put one in that worked we would not be in as much shit as we are today. I know you, you can't see beyond your need to attack NL, and in this case defend the well paid professional presumably intelligent individuals that run the Banks. You really are a single minded sad poster. Just another righty bereft of the ability to be objective. |

|

|

|

Post by dodgydave on Jan 28, 2023 2:49:03 GMT

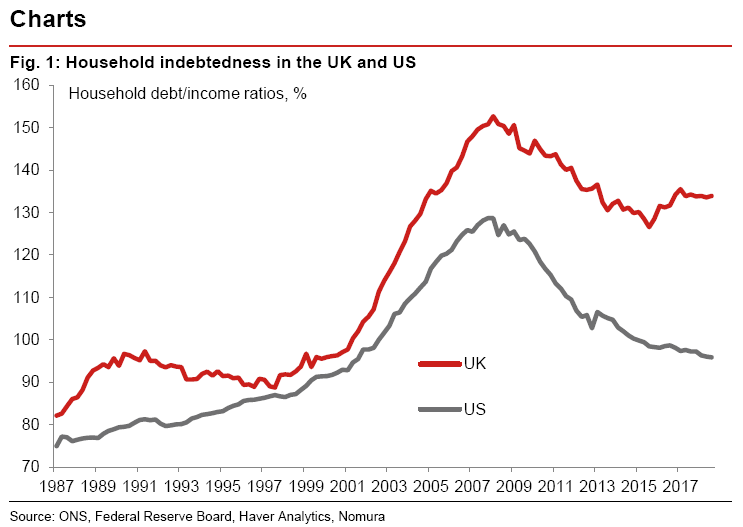

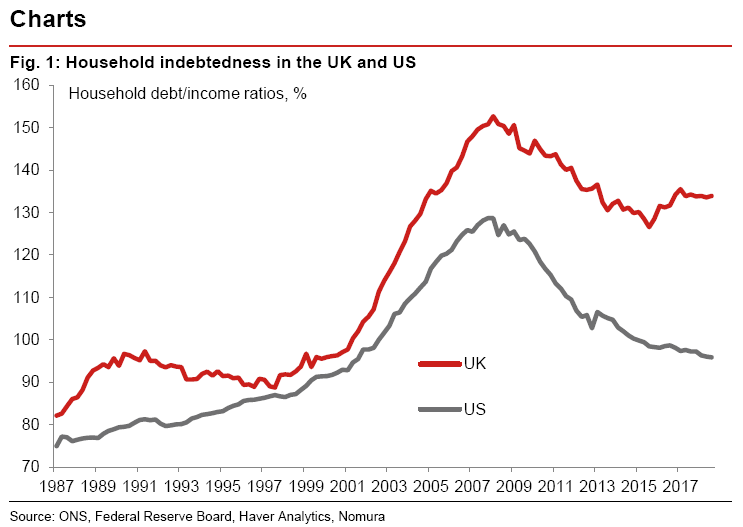

He took responsibility for putting in place a banking regulation system that failed - had he put one in that worked we would not be in as much shit as we are today. I know you, you can't see beyond your need to attack NL, and in this case defend the well paid professional presumably intelligent individuals that run the Banks. You really are a single minded sad poster. Just another righty bereft of the ability to be objective. Are you really trying to pretend that if something happens on your watch you have no responsibility? I'm guessing you were alive when it happened, so why are you turning a blind eye to what was obvious at the time (just like Blair / Brown did at the time lol)? Under New Labour household debt went through the roof, and anybody that lived through it will remember how easy it was to get credit and a mortgage. You could sign a piece of paper to say you could afford a buy to let mortgage ffs!! There was warning galore about what was about to happen, yet here you are pretending everybody was ignorant. All the warnings were there, and Japan had just shown the world what happens with debt bubbles and irresponsible lending!!  |

|

|

|

Post by see2 on Jan 28, 2023 9:00:29 GMT

I know you, you can't see beyond your need to attack NL, and in this case defend the well paid professional presumably intelligent individuals that run the Banks. You really are a single minded sad poster. Just another righty bereft of the ability to be objective. Are you really trying to pretend that if something happens on your watch you have no responsibility? I'm guessing you were alive when it happened, so why are you turning a blind eye to what was obvious at the time (just like Blair / Brown did at the time lol)? Under New Labour household debt went through the roof, and anybody that lived through it will remember how easy it was to get credit and a mortgage. You could sign a piece of paper to say you could afford a buy to let mortgage ffs!! There was warning galore about what was about to happen, yet here you are pretending everybody was ignorant. All the warnings were there, and Japan had just shown the world what happens with debt bubbles and irresponsible lending!!  Not no responsibility, just not total responsibility. The difference between the UK and US debt is that the US debt, especially mortgage debt, was abused and fouled up. People looking for a normal mortgage were being talked into going Sub Prime, which carried heavier penalties for arrears. Another problem that arose at that time was, I recall an interview with one American who explained that he followed a trend of changing the mortgage lender for one offering a lower interest rate and promising not to increase the interest rate. Only to later find the his mortgage had been sold on and the new lender increased the Interest rate above the original rate. The guy could no longer afford his mortgage. The US mortgages and debts became worthless, meaning that Western Banks with investment in this area, often apparently unaware because bulk buying of investment blocks included some of these debts and mortgages, suddenly found the money in the Bank was worthless. There was NEVER a warning of the forthcoming international financial meltdown. 2008 is when the UK debt became a problem, and the problem was not the debt per se, it was the disappearance of the money in the banks. |

|

|

|

Post by Orac on Jan 28, 2023 10:27:07 GMT

The sub-prime thing in the us was partially the result of political pressure on the banks.

The government (or some pressure groups) noticed that banks were not lending money to people who might well not be able to pay the money back. This policy was cast as discriminatory and the banks were asked to adjust their policy to be non-discriminatory. This adjustment followed many years of various governmental and private pressure groups harassing the banks about racist lending policies. In fact, I believe there was even some investigation into a creditworthiness AI on the suspicion that it might be racist. Of course, being a nation, we have (or should have) our own controls. It was obvious to many people that lending and indebtedness was out of control and heading for a disaster.

|

|

|

|

Post by see2 on Jan 28, 2023 10:50:54 GMT

The sub-prime thing in the us was partially the result of political pressure on the banks. The government (or some pressure groups) noticed that banks were not lending money to people who might well not be able to pay the money back. This policy was cast as discriminatory and the banks were asked to adjust their policy to be non-discriminatory. This adjustment followed many years of various governmental and private pressure groups harassing the banks about racist lending policies. In fact, I believe there was even some investigation into a creditworthiness AI on the suspicion that it might be racist. Of course, being a nation, we have (or should have) our own controls. It was obvious to many people that lending and indebtedness was out of control and heading for a disaster. The sub-Prime mortgages were designed to allow people in the US on a lower income to take out a mortgage, the system was abused by the mortgage lenders and went bust. It had nothing to do with the UK economy until it went bust and the Americans failed to rescue the Banks. The American bust brushed UK controls aside as money around the Western economies disappeared from the Banks as a result of having sub-prime worthless Mortgages and debts in them. |

|

|

|

Post by Orac on Jan 28, 2023 11:08:14 GMT

The sub-Prime mortgages were designed to allow people in the US on a lower income to take out a mortgage, the system was abused by the mortgage lenders and went bust. You are using words to whitewash reality. The banks were used as vehicles for social policy. They were pressured to 'find a way' to take on risks that weren't commercially defendable and they did the entirely predictable thing - the way they found was to camouflage those risks and pass them on to others. People told them this would happen and anyone armed with a basic knowledge of economics can see why it would happen. What the administration probably wanted to do was take control of the banks and simply hand the money over to their various client groups. However, the us constitution wouldn't allow that. |

|

|

|

Post by Red Rackham on Jan 28, 2023 11:16:55 GMT

By the way, just thought I'd mention I voted for John 'The Bastard' Major, and I'm pleased to see at least one other person did likewise.  |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jan 28, 2023 11:56:03 GMT

By the way, just thought I'd mention I voted for John 'The Bastard' Major, and I'm pleased to see at least one other person did likewise.  That was I. |

|

|

|

Post by Baron von Lotsov on Jan 28, 2023 14:11:16 GMT

The sub-prime thing in the us was partially the result of political pressure on the banks. The government (or some pressure groups) noticed that banks were not lending money to people who might well not be able to pay the money back. This policy was cast as discriminatory and the banks were asked to adjust their policy to be non-discriminatory. This adjustment followed many years of various governmental and private pressure groups harassing the banks about racist lending policies. In fact, I believe there was even some investigation into a creditworthiness AI on the suspicion that it might be racist. Of course, being a nation, we have (or should have) our own controls. It was obvious to many people that lending and indebtedness was out of control and heading for a disaster. Yes but then the real trouble occurred when Goldman Sachs disguised the debt as a more marketable commodity using derivatives which were misleading. Investors got burnt. Without the miss selling, the market would have corrected itself. The lenders would run out of backing. |

|

|

|

Post by Orac on Jan 28, 2023 14:14:20 GMT

Yes but then the real trouble occurred when Goldman Sachs disguised the debt as a more marketable commodity using derivatives which were misleading. Investors got burnt. Without the miss selling, the market would have corrected itself. The lenders would run out of backing. If the market had been allowed to do it's thing, then the lending wouldn't have started in the first place because the loans made no commercial sense. Political pressure was applied to make the loans available - ie social policy was being conducted via banks. |

|

|

|

Post by Baron von Lotsov on Jan 28, 2023 14:40:23 GMT

Yes but then the real trouble occurred when Goldman Sachs disguised the debt as a more marketable commodity using derivatives which were misleading. Investors got burnt. Without the miss selling, the market would have corrected itself. The lenders would run out of backing. If the market had been allowed to do it's thing, then the lending wouldn't have started in the first place because the loans made no commercial sense. Political pressure was applied to make the loans available - ie social policy was being conducted via banks. There are always fools in the market, but I'm saying they would have got wiped out and served as lessons to others. So it may have started via political persuasion but not got very far. A bit like Britishvolt I suppose. That was never viable. |

|

|

|

Post by Orac on Jan 28, 2023 14:52:17 GMT

If the market had been allowed to do it's thing, then the lending wouldn't have started in the first place because the loans made no commercial sense. Political pressure was applied to make the loans available - ie social policy was being conducted via banks. There are always fools in the market, but I'm saying they would have got wiped out and served as lessons to others. So it may have started via political persuasion but not got very far. A bit like Britishvolt I suppose. That was never viable. There seem to be blank patches in your comprehension of what I'm saying. It wasn't a viable option for the banks to employ racist lending practices and going bankrupt is also not a viable option. |

|

|

|

Post by Baron von Lotsov on Jan 28, 2023 15:02:29 GMT

There are always fools in the market, but I'm saying they would have got wiped out and served as lessons to others. So it may have started via political persuasion but not got very far. A bit like Britishvolt I suppose. That was never viable. There seem to be blank patches in your comprehension of what I'm saying. It wasn't a viable option for the banks to employ racist lending practices and going bankrupt is also not a viable option. Well neither could you argue that banks employing the woke is a good business decision for that matter. I know what you are saying, but although I almost agree, I'm adding in a bit of a correction for simply how they think over that way. It's not a free market economy. Banks, lawyers, government and military are like one big cult. What people claim about the government in China interfering with the running of private corporations is really a problem in the US than it is over that way. If you get blackballed as a bank you go under. We've seen the so-called "rogue traders". |

|

|

|

Post by patman post on Jan 28, 2023 15:17:18 GMT

I see three prime ministers who have dragged the UK down to its lowest level since 1945 — Eden over Suez, Johnson (as a complete scumbag lacking is morals and honesty, who's left a coating of slime and corruption over Westminster, since his premiership), and Truss, whose inability to accept her economic and political views came from Toyland, pushed the pound to its lowest-ever level against the dollar. Thanks to those three, I reckon Britain’s power on the world stage is now permanently diminished.

Macmillan and Thatcher brought sense, sanity and a bit of overall stability into Britain, but their efforts were eventually sabotaged by a hardcore destructive old school faction of their own party...

|

|

|

|

Post by thomas on Jan 28, 2023 15:29:54 GMT

The sub-prime thing in the us was partially the result of political pressure on the banks. The government (or some pressure groups) noticed that banks were not lending money to people who might well not be able to pay the money back. This policy was cast as discriminatory and the banks were asked to adjust their policy to be non-discriminatory. This adjustment followed many years of various governmental and private pressure groups harassing the banks about racist lending policies. In fact, I believe there was even some investigation into a creditworthiness AI on the suspicion that it might be racist. Of course, being a nation, we have (or should have) our own controls. It was obvious to many people that lending and indebtedness was out of control and heading for a disaster.

The American bust brushed UK controls aside as money around the Western economies disappeared from the Banks as a result of having sub-prime worthless Mortgages and debts in them. I thought gordon brown apologised publicly for relaxing banking controls which led to the financial crash under labours watch ? Here you are , yet again , blaming someone , anyone else for problems your own former labour chancellor and prime minister admitted were his fault?

You are a laugh a minute see 2 .Stope it now , you are embarressing yourself.

|

|