|

|

Post by Ripley on Mar 9, 2023 18:07:19 GMT

I have to dispute it not least because 40 years ago, 30 years ago and 20 years ago I was saying the USA was in trouble and every time I was wrong. Their economy seems to defy gravity and it does seem to be that super critical mass effect. Having huge mineral/fossil fuel reserves doesn't harm them either. I'd say their biggest crisis is the water to resident ratio. They have shifted largely their manufacturing to China so apart from food they are largely a service economy. Traditionally via OPEC and arms bases in the Persian Gulf have allowed them 'to set' the oil price and hence the old term petro-dollar. The demand for US$ allows them via a budget deficit to have so many people under arms in bases abroad according to some. Russian oil priced in other currencies and according to some, what Saddam tried to with Iraqi oil threatens their ability to run such a large budget deficit. China does buy oil from Iran and Russia and recently these huge payments are now made in local currency. So the US$ around the world is not needed so much for trade, this should cause a reduction of its military presence abroad not happened so far yet is prompting people to ask questions. After a three year drought, California has been getting a lot of rain and snow. It will take more than one wet year to overcome the drought, but California's precipitation can vary greatly from year to year and it manages to thrive in spite of that. California is the largest sub-national economy in the world. If it were a sovereign nation, it would rank as the world's fifth largest economy in terms of nominal GDP, ahead of India. Its gross state product was $3.63 trillion last year. |

|

|

|

Post by Baron von Lotsov on Mar 9, 2023 18:59:44 GMT

Yes Steve don’t dispute that but do you dismiss the idea the US is in (a slow) decline? I have to dispute it not least because 40 years ago, 30 years ago and 20 years ago I was saying the USA was in trouble and every time I was wrong. Their economy seems to defy gravity and it does seem to be that super critical mass effect. Having huge mineral/fossil fuel reserves doesn't harm them either. I'd say their biggest crisis is the water to resident ratio. A lot has happened in the last 10 years, e.g. the BRI. Don't underestimate its purpose. |

|

|

|

Post by Steve on Mar 10, 2023 9:25:44 GMT

|

|

|

|

Post by bancroft on Mar 10, 2023 12:11:53 GMT

Water is an interesting point certainly an issue in California not sure on other areas.They have shifted largely their manufacturing to China so apart from food they are largely a service economy. Traditionally via OPEC and arms bases in the Persian Gulf have allowed them 'to set' the oil price and hence the old term petro-dollar. The demand for US$ allows them via a budget deficit to have so many people under arms in bases abroad according to some. Russian oil priced in other currencies and according to some, what Saddam tried to with Iraqi oil threatens their ability to run such a large budget deficit. China does buy oil from Iran and Russia and recently these huge payments are now made in local currency. So the US$ around the world is not needed so much for trade, this should cause a reduction of its military presence abroad not happened so far yet is prompting people to ask questions. After a three year drought, California has been getting a lot of rain and snow. It will take more than one wet year to overcome the drought, but California's precipitation can vary greatly from year to year and it manages to thrive in spite of that. California is the largest sub-national economy in the world. If it were a sovereign nation, it would rank as the world's fifth largest economy in terms of nominal GDP, ahead of India. Its gross state product was $3.63 trillion last year. I read they were considering building technology to convert sea water to fresh water too. |

|

|

|

Post by Baron von Lotsov on Mar 10, 2023 19:55:36 GMT

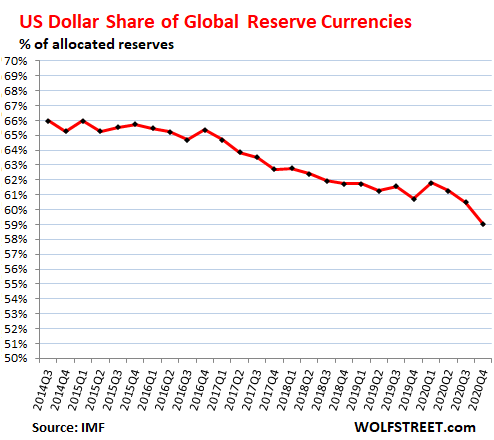

Well it certainly is interesting to look at the rest of the picture and see what the other currencies are doing on this measure. If we look at the last ten years, what we see in addition to the dollar dropping as in the plot, is we also see the euro dropping, although not by so much as the dollar, but you'd intuitively think as the EU gets larger it would go the other way. What might be even more surprising, given the continual doom and gloom in the Uk during this time is the pound has risen quite a bit. Central banks look like they are exchanging dollars for pounds as a safer bet, and remember this is inline with the increasing view that we might leave the EU. Mind you this has not been mentioned by the MSM as far as I know. |

|

|

|

Post by wapentake on Mar 10, 2023 23:01:08 GMT

I have to dispute it not least because 40 years ago, 30 years ago and 20 years ago I was saying the USA was in trouble and every time I was wrong. Their economy seems to defy gravity and it does seem to be that super critical mass effect. Having huge mineral/fossil fuel reserves doesn't harm them either. I'd say their biggest crisis is the water to resident ratio. Water is an interesting point certainly an issue in California not sure on other areas. They have shifted largely their manufacturing to China so apart from food they are largely a service economy. Traditionally via OPEC and arms bases in the Persian Gulf have allowed them 'to set' the oil price and hence the old term petro-dollar. The demand for US$ allows them via a budget deficit to have so many people under arms in bases abroad according to some. Russian oil priced in other currencies and according to some, what Saddam tried to with Iraqi oil threatens their ability to run such a large budget deficit. China does buy oil from Iran and Russia and recently these huge payments are now made in local currency. So the US$ around the world is not needed so much for trade, this should cause a reduction of its military presence abroad not happened so far yet is prompting people to ask questions.And they accept Taiwan will be invaded and are playing catch-up and trying to build a coalition which following the Afghan debacle with Bidens surprise withdrawal difficult to sell to others I’d have thought. www.dailymail.co.uk/debate/article-11846065/ANDREW-NEIL-Washington-talk-not-China-invades-Taiwan.html |

|

|

|

Post by bancroft on Mar 11, 2023 12:19:51 GMT

Yes Taiwan could be a flashpoint yet the long game is the younger generation might want to join with China.

|

|

|

|

Post by Baron von Lotsov on Mar 11, 2023 15:58:17 GMT

Water is an interesting point certainly an issue in California not sure on other areas. They have shifted largely their manufacturing to China so apart from food they are largely a service economy. Traditionally via OPEC and arms bases in the Persian Gulf have allowed them 'to set' the oil price and hence the old term petro-dollar. The demand for US$ allows them via a budget deficit to have so many people under arms in bases abroad according to some. Russian oil priced in other currencies and according to some, what Saddam tried to with Iraqi oil threatens their ability to run such a large budget deficit. China does buy oil from Iran and Russia and recently these huge payments are now made in local currency. So the US$ around the world is not needed so much for trade, this should cause a reduction of its military presence abroad not happened so far yet is prompting people to ask questions.And they accept Taiwan will be invaded and are playing catch-up and trying to build a coalition which following the Afghan debacle with Bidens surprise withdrawal difficult to sell to others I’d have thought. www.dailymail.co.uk/debate/article-11846065/ANDREW-NEIL-Washington-talk-not-China-invades-Taiwan.htmlChina really does not want to invade Taiwan at all. The thinking at the CPC is to make it into a region like Hong Kong and their infamous saying "One country - two systems". They want to do it diplomatically, but there are big issues to resolve and the biggest of all is microchips, the main industry in Taiwan. It's really one firm, called TSMC, so on their side they have to deal with what TSMC wants to do, and right now TSMC wants to integrate with the mainland in the chip industry. They have built a fab there, i.e. sunk tens of billions of dollars into investment on the mainland. This is the core issue, because it is where they get their money from. There are big benefits to closer indusial integration, and obviously the Taiwanese want good paying jobs. One bone of contention is that the workers don't get paid that much in Taiwan, so they see their cousins on the mainland doing the same job for twice the salary. I think you can sum it up as saying money talks, bullshit walks over that way. |

|