|

|

Post by wapentake on Mar 8, 2023 13:14:27 GMT

|

|

|

|

Post by Baron von Lotsov on Mar 8, 2023 14:01:47 GMT

|

|

|

|

Post by Ripley on Mar 8, 2023 22:43:59 GMT

China and the US are inextricably linked in an interdependent trade relationship which I believe both sides will prioritize in spite of their differences. "China wants to avoid an escalation of tensions with the United States and believes it benefits from a more stable relationship with Washington, even as it seeks to bolster its global economic and military power, U.S. intelligence chief Avril Haines told lawmakers on Wednesday. Despite recent sharp criticism of the U.S. by Chinese President Xi Jinping, “we assess that Beijing still believes it benefits most by preventing a spiraling of tensions and by preserving stability in its relationship with the United States,” Haines told a hearing of the Senate Intelligence Committee. China is increasingly challenging the United States, economically, technologically, politically and militarily around the world and “remains our unparalleled priority,” said Haines. Haines and other intelligence officials appeared at the hearing as part of an annual assessment from the intelligence community on global threats facing the United States. "The intelligence community’s report on global threats , which was released earlier Wednesday, said Chinese leaders would look to try to divide the U.S. and its allies but also reduce friction with the U.S. when it suited Beijing’s agenda. “As Xi begins his third term as China’s leader, the CCP (Chinese Communist Party) will work to press Taiwan on unification, undercut U.S. influence, drive wedges between Washington and its partners, and foster some norms that favor its authoritarian system,” the report said. “At the same time, China’s leaders probably will seek opportunities to reduce tensions with Washington when they believe it suits their interests.” www.msn.com/en-us/news/world/china-wants-to-avoid-escalation-with-u-s-favors-stable-relations-u-s-spy-chief-says/ar-AA18nmUB?ocid=hpmsn&cvid=ab6f968334634d2a9e0d13401e00a074&ei=20 |

|

|

|

Post by Steve on Mar 8, 2023 22:58:19 GMT

The end of the mighty dollar? That would be the US$ that's up on the £ this year and up on the € this year. And on the last five years I wouldn't be expecting its funeral any time soon, far from it. The USA is a super critical mass economy, it generates so much money from its intellectual property riches and its ability to lever its market mass to get friendly positions from so many industrial partners and countries. |

|

|

|

Post by wapentake on Mar 8, 2023 23:21:02 GMT

The end of the mighty dollar? That would be the US$ that's up on the £ this year and up on the € this year. And on the last five years I wouldn't be expecting its funeral any time soon, far from it. The USA is a super critical mass economy, it generates so much money from its intellectual property riches and its ability to lever its market mass to get friendly positions from so many industrial partners and countries. Yes Steve don’t dispute that but do you dismiss the idea the US is in (a slow) decline? |

|

|

|

Post by Ripley on Mar 9, 2023 0:30:08 GMT

We're all struggling back from the fallout from the pandemic, including China. In 2022, China grew its economy by 3%, falling far short of its 5.5% GDP growth target. This week, China has just announced its lowest GDP growth target in decades, set at 'around 5%'. On March 5th, Chinese Premier Li Kiqiang said: "“Insufficient demand is still a prominent issue. Stabilizing employment is tough. And some local governments face big fiscal difficulties.” "Nomura analysts said the 5% growth target suggests “the government is conservative but pragmatic about the economic prospects in 2023, with weakening global demand taking a toll on exports, worsening geopolitical tensions and a still-moderate recovery in the housing sector.” The new State Council, China’s cabinet, is also “taking a lesson” from the substantial miss in growth target last year, they added." "China is in the midst of a historic downturn for the all-important housing market. Consumer spending is sluggish. Unemployment remains high among the youth. Business confidence has plummeted following an unprecedented regulatory crackdown on the private sector and increased uncertainties about China’s future policy. Relations between the United States and China are at their lowest point in decades, leading to escalating tensions in technology and investment. Foreign investment in China has slumped." www.msn.com/en-us/money/markets/china-sets-lowest-gdp-growth-target-in-decades-as-beijing-tightens-its-belt/ar-AA18gXY1 |

|

|

|

Post by Pacifico on Mar 9, 2023 7:41:27 GMT

That would be the US$ that's up on the £ this year and up on the € this year. And on the last five years I wouldn't be expecting its funeral any time soon, far from it. The USA is a super critical mass economy, it generates so much money from its intellectual property riches and its ability to lever its market mass to get friendly positions from so many industrial partners and countries. Yes Steve don’t dispute that but do you dismiss the idea the US is in (a slow) decline? People have been saying that for the past 50 years - and yet here we are. At some point it might happen but everyone on this forum will be long dead by then. |

|

|

|

Post by wapentake on Mar 9, 2023 10:09:06 GMT

Yes Steve don’t dispute that but do you dismiss the idea the US is in (a slow) decline? People have been saying that for the past 50 years - and yet here we are. At some point it might happen but everyone on this forum will be long dead by then. They might’ve been saying it 50 years ago but then they were at their Zenith man already landed on the moon technology and power that saw off the soviet union eventually. Now we are in a different place and though I don’t doubt it won’t happen overnight look at the British empire and it’s decline it happens to all it’s what takes it’s place and that started a while ago. |

|

|

|

Post by Steve on Mar 9, 2023 11:14:03 GMT

That would be the US$ that's up on the £ this year and up on the € this year. And on the last five years I wouldn't be expecting its funeral any time soon, far from it. The USA is a super critical mass economy, it generates so much money from its intellectual property riches and its ability to lever its market mass to get friendly positions from so many industrial partners and countries. Yes Steve don’t dispute that but do you dismiss the idea the US is in (a slow) decline? I have to dispute it not least because 40 years ago, 30 years ago and 20 years ago I was saying the USA was in trouble and every time I was wrong. Their economy seems to defy gravity and it does seem to be that super critical mass effect. Having huge mineral/fossil fuel reserves doesn't harm them either. I'd say their biggest crisis is the water to resident ratio. |

|

|

|

Post by Pacifico on Mar 9, 2023 13:03:24 GMT

People have been saying that for the past 50 years - and yet here we are. At some point it might happen but everyone on this forum will be long dead by then. They might’ve been saying it 50 years ago but then they were at their Zenith man already landed on the moon technology and power that saw off the soviet union eventually. Now we are in a different place and though I don’t doubt it won’t happen overnight look at the British empire and it’s decline it happens to all it’s what takes it’s place and that started a while ago. But you need something to replace it with and there is nothing on the horizon. |

|

|

|

Post by wapentake on Mar 9, 2023 13:40:46 GMT

They might’ve been saying it 50 years ago but then they were at their Zenith man already landed on the moon technology and power that saw off the soviet union eventually. Now we are in a different place and though I don’t doubt it won’t happen overnight look at the British empire and it’s decline it happens to all it’s what takes it’s place and that started a while ago. But you need something to replace it with and there is nothing on the horizon. In the west no and (for us) that’s the problem,China is the worlds next superpower they’re already beginning to overtake with some military technology. |

|

|

|

Post by Baron von Lotsov on Mar 9, 2023 15:04:13 GMT

The end of the mighty dollar? That would be the US$ that's up on the £ this year and up on the € this year. And on the last five years I wouldn't be expecting its funeral any time soon, far from it. The USA is a super critical mass economy, it generates so much money from its intellectual property riches and its ability to lever its market mass to get friendly positions from so many industrial partners and countries. Like the US housing market in 2007. |

|

|

|

Post by Baron von Lotsov on Mar 9, 2023 15:07:17 GMT

That would be the US$ that's up on the £ this year and up on the € this year. And on the last five years I wouldn't be expecting its funeral any time soon, far from it. The USA is a super critical mass economy, it generates so much money from its intellectual property riches and its ability to lever its market mass to get friendly positions from so many industrial partners and countries. Yes Steve don’t dispute that but do you dismiss the idea the US is in (a slow) decline?  |

|

|

|

Post by bancroft on Mar 9, 2023 15:07:57 GMT

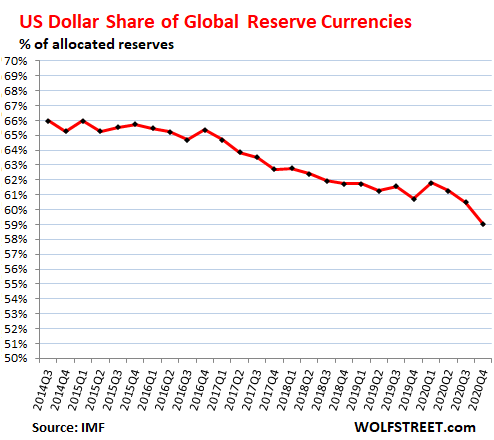

Yes Steve don’t dispute that but do you dismiss the idea the US is in (a slow) decline? I have to dispute it not least because 40 years ago, 30 years ago and 20 years ago I was saying the USA was in trouble and every time I was wrong. Their economy seems to defy gravity and it does seem to be that super critical mass effect. Having huge mineral/fossil fuel reserves doesn't harm them either. I'd say their biggest crisis is the water to resident ratio. Water is an interesting point certainly an issue in California not sure on other areas. They have shifted largely their manufacturing to China so apart from food they are largely a service economy. Traditionally via OPEC and arms bases in the Persian Gulf have allowed them 'to set' the oil price and hence the old term petro-dollar. The demand for US$ allows them via a budget deficit to have so many people under arms in bases abroad according to some. Russian oil priced in other currencies and according to some, what Saddam tried to with Iraqi oil threatens their ability to run such a large budget deficit. China does buy oil from Iran and Russia and recently these huge payments are now made in local currency. So the US$ around the world is not needed so much for trade, this should cause a reduction of its military presence abroad not happened so far yet is prompting people to ask questions. |

|

|

|

Post by bancroft on Mar 9, 2023 15:13:27 GMT

Should also have added large countries are cashing out of US treasury bonds driving down the price.

They can print money yet only for so long.

|

|