|

|

Post by andrewbrown on Feb 6, 2023 17:52:39 GMT

We are talking about workers, not work shy.

|

|

|

|

Post by Orac on Feb 6, 2023 17:52:47 GMT

As a moderator, you'll be able to point out where I have said either of those things? Perhaps I have somehow misunderstood. It should be a simple enough matter for you to point out which of two positions you do not hold. Not sure what my moderator status has to do with it |

|

|

|

Post by jonksy on Feb 6, 2023 17:58:06 GMT

We are talking about workers, not work shy. And I am talking about reality. I will ask you yet again how much are you prepared to pay? |

|

|

|

Post by Fairsociety on Feb 6, 2023 18:00:00 GMT

1. Minimum wage is down to the employer not the government, the government can take employers to court for not complying, but the employer will use the 'loophole' of zero hours contracts as a way round it.

3. We can't have a society where people keep popping kids out and expect the tax payers to foot the bill for them, it comes down to taking responsibility for your actions, the government have brought in a 'minimum wage' to tackle low paid workers. Employer's who appear to be taking advantage of loopholes are the big conglomerates who are taking advantage of loopholes so the tax payers subsidise their employees. Time the government came down hard on the these leaches, the same leaches who claimed millions of tax payers money in furlough.

I hope this clears up points 1 & 3, I am afraid you are blaming the government for why parents of children are in poverty, I suggest you target the real offenders and culprits, employer's who taking advantage of their employees, and the tax payers. You can't forget all those who will only make themselves available to work for a maximum of 16 hours a week and refusing all offers of work above that . That way they are still entitled to claim full welfare benefits and do so with relish and it's nothing to do with employers or poor wages This showed that a single-mother-of-two, paying £2,000 a month in rent in London, would receive £36,663 a year in tax-free Universal Credit if she worked 16 hours a week at £9.50 an hour – bringing her gross income to £44,567.60.

But if she decided to work three days a week instead of two, because she would lose some of her Universal Credit entitlement, her gross income would only edge up by £2,172 a year to £46,348 - equivalent to £34 extra a week. Add in childcare and transport costs, and the money she earned from that third day of work would be wiped out.

The disincentive to work is almost as strong for couples with children. If each parent works for one day a week, they could expect to take home a joint income of £46,856, of which almost £39,000 would be paid from the public purse. But if those parents worked three days a week between them, their gross income would also only increase by £34 a week.

www.telegraph.co.uk/news/2022/12/09/britains-jobless-crisis-fuelled-benefits-loophole-encourages/

No, I think we agree. And I entirely blame the employers. As long as employers pay their staff the minimum wage or above they are whithin the law. That is why the law was introduced. As long as employers pay their staff the minimum wage or above they are whithin the law. That is why the law was introduced. I agree. But the problem is, as Fairsociety has already pointed out, that the legal minimum wage is not enough for basic living needs. By about £5,000. But as ratcliff points out if tax credit claimants work more than 16 hour a week they end up worse off because they are penalised, so why would any one in their right mind work more than 16 hours a week to earn less money? |

|

|

|

Post by andrewbrown on Feb 6, 2023 18:02:14 GMT

As a moderator, you'll be able to point out where I have said either of those things? Perhaps I have somehow misunderstood. It should be a simple enough matter for you to point out which of two positions you do not hold. Not sure what my moderator status has to do with it I don't hold either of those positions. Your role as moderator is purely a presumption on my behalf that you can view my posts. Apologies if that is not the case. |

|

|

|

Post by andrewbrown on Feb 6, 2023 18:08:54 GMT

You can't forget all those who will only make themselves available to work for a maximum of 16 hours a week and refusing all offers of work above that . That way they are still entitled to claim full welfare benefits and do so with relish and it's nothing to do with employers or poor wages This showed that a single-mother-of-two, paying £2,000 a month in rent in London, would receive £36,663 a year in tax-free Universal Credit if she worked 16 hours a week at £9.50 an hour – bringing her gross income to £44,567.60.

But if she decided to work three days a week instead of two, because she would lose some of her Universal Credit entitlement, her gross income would only edge up by £2,172 a year to £46,348 - equivalent to £34 extra a week. Add in childcare and transport costs, and the money she earned from that third day of work would be wiped out.

The disincentive to work is almost as strong for couples with children. If each parent works for one day a week, they could expect to take home a joint income of £46,856, of which almost £39,000 would be paid from the public purse. But if those parents worked three days a week between them, their gross income would also only increase by £34 a week.

www.telegraph.co.uk/news/2022/12/09/britains-jobless-crisis-fuelled-benefits-loophole-encourages/

As long as employers pay their staff the minimum wage or above they are whithin the law. That is why the law was introduced. I agree. But the problem is, as Fairsociety has already pointed out, that the legal minimum wage is not enough for basic living needs. By about £5,000. But as ratcliff points out if tax credit claimants work more than 16 hour a week they end up worse off because they are penalised, so why would any one in their right mind work more than 16 hours a week to earn less money? There is a small number of more complicated cases where the loss of benefits is similar to to the increase in earnings. The government lowered the taper last year to alleviate this issue. General rule of thumb, work more hours more income. |

|

|

|

Post by Orac on Feb 6, 2023 18:10:35 GMT

I don't hold either of those positions. To be clear, Andrewwbrown holds neither of the two positions outlined below - 1) Everyone has a right to enter the UK. 2) Everyone in the uk has a right to be supported in their reproductive choices by the taxpayer. |

|

|

|

Post by andrewbrown on Feb 6, 2023 18:18:17 GMT

Correct.

|

|

|

|

Post by jonksy on Feb 6, 2023 18:21:33 GMT

So, How much MORE are YOU prepared to pay to keep these individuals in the way they have become accustomed? |

|

|

|

Post by andrewbrown on Feb 6, 2023 18:27:49 GMT

So, How much MORE are YOU prepared to pay to keep these individuals in the way they have become accustomed? Depends on what you mean. If you mean the government, then no, I want them to be paying less. I think I made it clear earlier that we have been subsidising employers and that is unsustainable. However, I do accept that this means employer costs will be higher, and therefore the price of goods and services will rise. Edit: you refer to "way that they have been accustomed", but Fairsociety's figures clearly talk about basic needs. |

|

|

|

Post by ratcliff on Feb 6, 2023 18:52:20 GMT

But as ratcliff points out if tax credit claimants work more than 16 hour a week they end up worse off because they are penalised, so why would any one in their right mind work more than 16 hours a week to earn less money? There is a small number of more complicated cases where the loss of benefits is similar to to the increase in earnings. The government lowered the taper last year to alleviate this issue. General rule of thumb, work more hours more income. What is complicated about this? She's getting just under £37000 tax free from the taxpayer for doing sfa so would be nuts to work (also tax free as below the personal allowance) more than 16 hours This showed that a single-mother-of-two, paying £2,000 a month in rent in London, would receive £36,663 a year in tax-free Universal Credit if she worked 16 hours a week at £9.50 an hour – bringing her gross income to £44,567.60.There's supposed to be a benefits cap - obviously it's so leaky an umbrella won't stop the piss taking |

|

|

|

Post by andrewbrown on Feb 6, 2023 18:57:57 GMT

There is a small number of more complicated cases where the loss of benefits is similar to to the increase in earnings. The government lowered the taper last year to alleviate this issue. General rule of thumb, work more hours more income. What is complicated about this? She's getting just under £37000 tax free from the taxpayer for doing sfa so would be nuts to work (also tax free as below the personal allowance) more than 16 hours This showed that a single-mother-of-two, paying £2,000 a month in rent in London, would receive £36,663 a year in tax-free Universal Credit if she worked 16 hours a week at £9.50 an hour – bringing her gross income to £44,567.60.There's supposed to be a benefits cap - obviously it's so leaky an umbrella won't stop the piss taking The benefit cap does not apply to working households, only workless households, with disabled people also not being capped. |

|

|

|

Post by ratcliff on Feb 6, 2023 19:08:20 GMT

What is complicated about this? She's getting just under £37000 tax free from the taxpayer for doing sfa so would be nuts to work (also tax free as below the personal allowance) more than 16 hours This showed that a single-mother-of-two, paying £2,000 a month in rent in London, would receive £36,663 a year in tax-free Universal Credit if she worked 16 hours a week at £9.50 an hour – bringing her gross income to £44,567.60.There's supposed to be a benefits cap - obviously it's so leaky an umbrella won't stop the piss taking The benefit cap does not apply to working households, only workless households, with disabled people also not being capped. Thus you are confirming exactly why the piss taking reluctant to works force themselves to get out of bed to do the barest minimum hours each week so they can ''top up'' to receive £857 a week completely tax free |

|

|

|

Post by zanygame on Feb 6, 2023 20:31:03 GMT

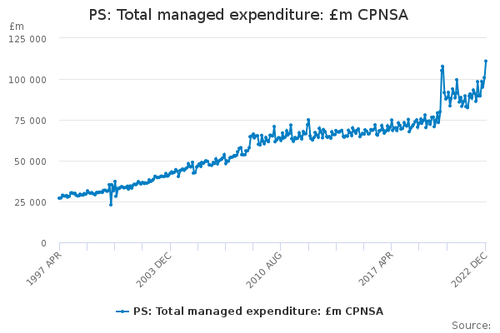

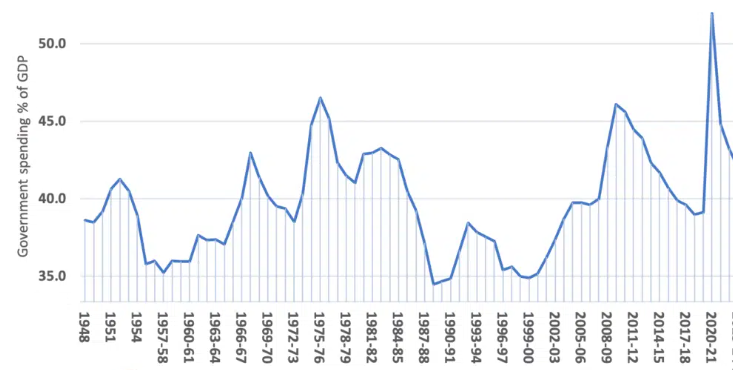

So you don't deny my words. And I can claim the huge costs of Covid and paying 30% of peoples electricity bills is the reason that government spending is at an all time high. You and I both know that's true, but are you honest enough to admit it? Public spending was rising before Covid and Ukraine - only WW2 has seen higher public spending  Public spending fell as a proportion of GDP from 2010 to 2020.   |

|

|

|

Post by jonksy on Feb 6, 2023 20:40:25 GMT

So, How much MORE are YOU prepared to pay to keep these individuals in the way they have become accustomed? Depends on what you mean. If you mean the government, then no, I want them to be paying less. I think I made it clear earlier that we have been subsidising employers and that is unsustainable. However, I do accept that this means employer costs will be higher, and therefore the price of goods and services will rise. Edit: you refer to "way that they have been accustomed", but Fairsociety's figures clearly talk about basic needs. Yes the way the lazy fuckers have become accustomed......They are paid enough for their basic needs......Why is it down to the taxpayers to pay for these lazy bastards who just piss the money they receive up the wall? |

|