|

|

Post by see2 on Feb 9, 2023 20:08:00 GMT

Why does the government collect taxes? In order to fund spending. It doesn't need to fund a tax cut because a tax cut is not spending Taxes are there in order for spending to happen. Tax cuts means that necessary spending by the government has to be covered in one way or another. That cover which would not be needed but for the tax cuts, is the cost of the Tax Cuts. |

|

|

|

Post by ratcliff on Feb 9, 2023 20:12:49 GMT

Let's pretend a country with no tax where a government decides it might be a nice idea to (for example) offer cooked meals for the elderly but does not have the money to pay for them so needs to organise how to FUND the idea for a trial service . It can borrow the funding , seek donation or it can impose a tax on incomes . If it then decides to reduce/remove the meal tax imposed that does not make the tax reduction unfunded. Far from it The government has to source different methods of funding or reduce/cut the service It's not tax cuts that are unfunded The tax cuts would be unfunded unless the services they were paying for were removed to pay for them, or the money was borrowed whilst the services were retained. Either way, withdrawal of taxes would be unfunded without the cancellation of the services they were funding to pay for them. Jesus christ, you lot, your semantic dances on a pinhead do not change reality. Nothing is for free. I do note the concerted effort by a number of you to derail a previously intelligent thread with this nitpicking semantic rubbish. Do you guys have something against intelligent threads or something? And the worst offender who started it all is a frigging mod, no less. No you simply do not understand my example There is NO tax in existence If there is some desired government spending it must be funded - I gave examples of options in my post To may it even easier for you to understand let's pretend that you currently work 5 days a week at £100 per day ie £500 a week and you spend £500 a week . You reduce your hours to 3 days so now receive £300 a week You will either need to find a different method of funding the spending or reduce spending Your reduced wages are not the unfunded item. |

|

|

|

Post by ratcliff on Feb 9, 2023 20:17:36 GMT

Hmmm, you have a large chip about grammar schools (generally state education) and consider grammar school pupils to be ''knob heads'' .......... you obviously failed the 11+ You are a LIAR ^^^ that makes your post worthless. Just a silly post from a poster of silly posts. If you had a thinking brain you would have noticed that I was referring to what "seemed to be" i.e. that's the appearance they give with their immature control of the media. And it never referred to all products of the grammar school system, just the knob heads. Private schools, Comprehensives, secondary moderns, church schools, home educated etc don't produce what you childishly call knob heads? Only grammar schools do so? |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Feb 9, 2023 20:41:00 GMT

Why does the government collect taxes? In order to fund spending. It doesn't need to fund a tax cut because a tax cut is not spending A tax cut needs to be funded by cutting expenditure, otherwise it is unfunded. This is really not difficult. |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Feb 9, 2023 20:45:44 GMT

The tax cuts would be unfunded unless the services they were paying for were removed to pay for them, or the money was borrowed whilst the services were retained. Either way, withdrawal of taxes would be unfunded without the cancellation of the services they were funding to pay for them. Jesus christ, you lot, your semantic dances on a pinhead do not change reality. Nothing is for free. I do note the concerted effort by a number of you to derail a previously intelligent thread with this nitpicking semantic rubbish. Do you guys have something against intelligent threads or something? And the worst offender who started it all is a frigging mod, no less. No you simply do not understand my example There is NO tax in existence If there is some desired government spending it must be funded - I gave examples of options in my post To may it even easier for you to understand let's pretend that you currently work 5 days a week at £100 per day ie £500 a week and you spend £500 a week . You reduce your hours to 3 days so now receive £300 a week You will either need to find a different method of funding the spending or reduce spending Your reduced wages are not the unfunded item. It would be an unaffordable, ie insufficiently funded, wage cut unless my spending could be cut in order to afford it. |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Feb 9, 2023 20:46:55 GMT

You are a LIAR ^^^ that makes your post worthless. Just a silly post from a poster of silly posts. If you had a thinking brain you would have noticed that I was referring to what "seemed to be" i.e. that's the appearance they give with their immature control of the media. And it never referred to all products of the grammar school system, just the knob heads. Private schools, Comprehensives, secondary moderns, church schools, home educated etc don't produce what you childishly call knob heads? Only grammar schools do so? Whichever one of those you attended has self evidently produced a knobhead. |

|

|

|

Post by ratcliff on Feb 9, 2023 21:20:55 GMT

Private schools, Comprehensives, secondary moderns, church schools, home educated etc don't produce what you childishly call knob heads? Only grammar schools do so? Whichever one of those you attended has self evidently produced a knobhead. How cutting ........not  |

|

|

|

Post by Orac on Feb 9, 2023 21:39:07 GMT

Your reduced wages are not the unfunded item. Indeed. Well said. Your wage drop is not unfunded - it's your spending that is unfunded. |

|

|

|

Post by Toreador on Feb 9, 2023 22:13:12 GMT

Tax cuts are free, it is the government's spending that costs money and needs to be funded. If tax cuts can be said to 'cost money', then the government can also be said to be funding society with any relative absence of taxation. This is patently absurd and an inversion of reality. Why does the government collect taxes? To spend quite a lot on waste. |

|

|

|

Post by Pacifico on Feb 9, 2023 22:21:46 GMT

Well if we are looking at New Labours record - their growth rates only look good if you exclude the Financial crisis. Yes they did great when they inherited a booming economy - but when a government does not inherit a booming economy and has to comply with EU rules on spending deficits it is a tad harder. Obviously you do not want to compare like with like and I can understand that, but from 2010 there is nothing that the Tories did that a Labour Government would not have done as well. Why did the Tories get kicked out if the economy was booming? Is it because only a few years before people lost everything because of Majors ERM vanity project and the Tories fix which involved 17% interest rates? Would that be it? Feel free to argue that the economy was not booming in 1997 - what do you base this metric on? With regards to your point about the ERM, the biggest advocate for ERM membership was a Mr Gordon Brown - I wonder what happened to him? |

|

|

|

Post by zanygame on Feb 9, 2023 23:27:06 GMT

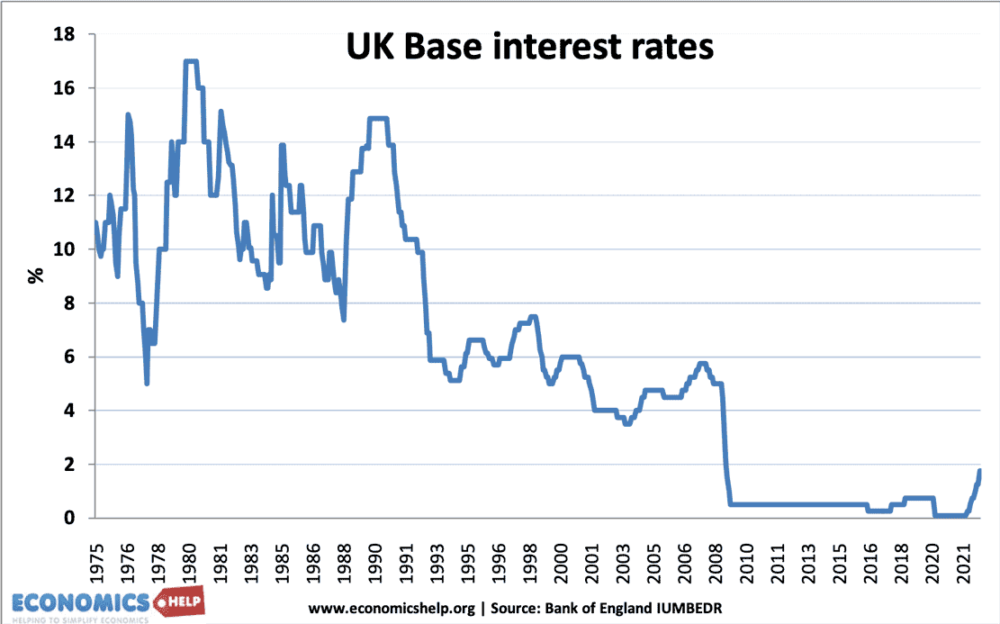

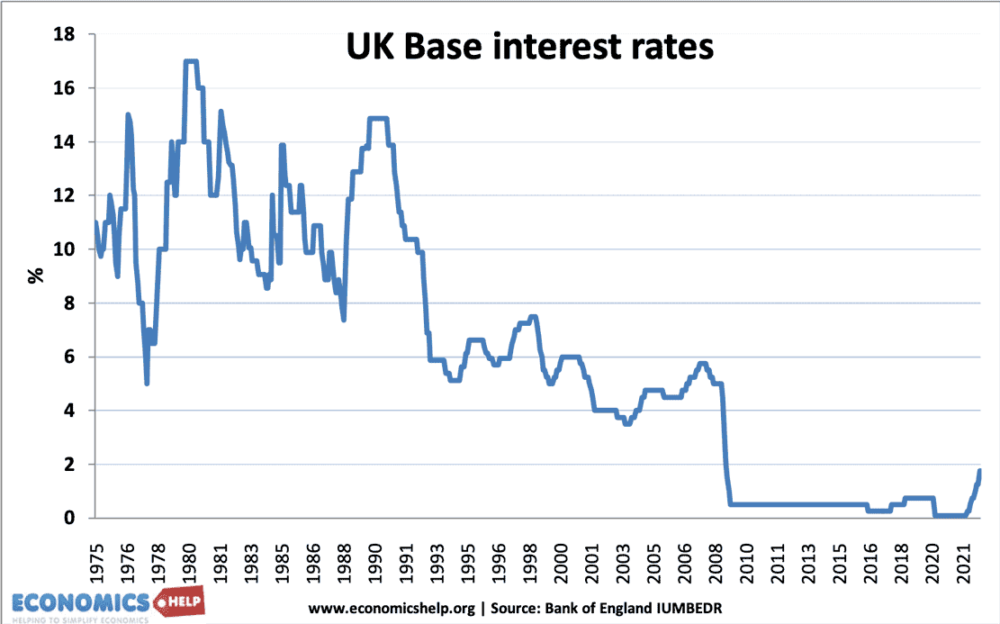

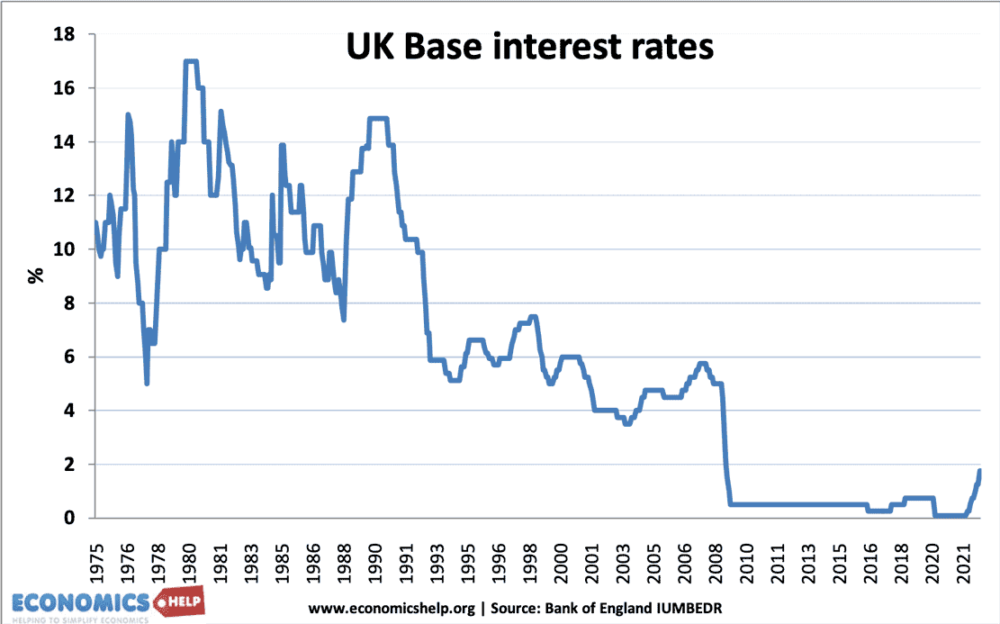

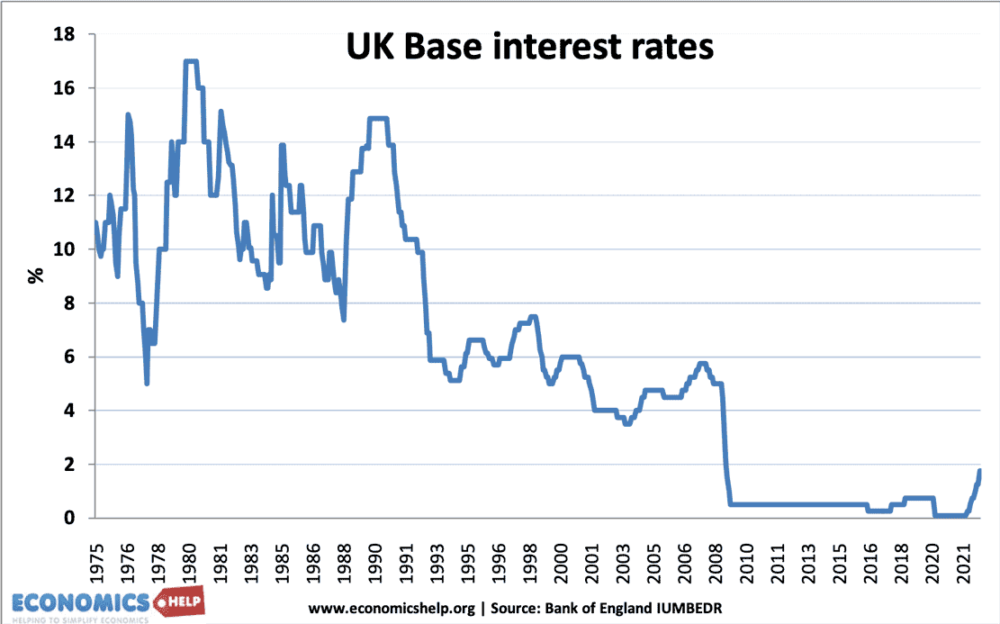

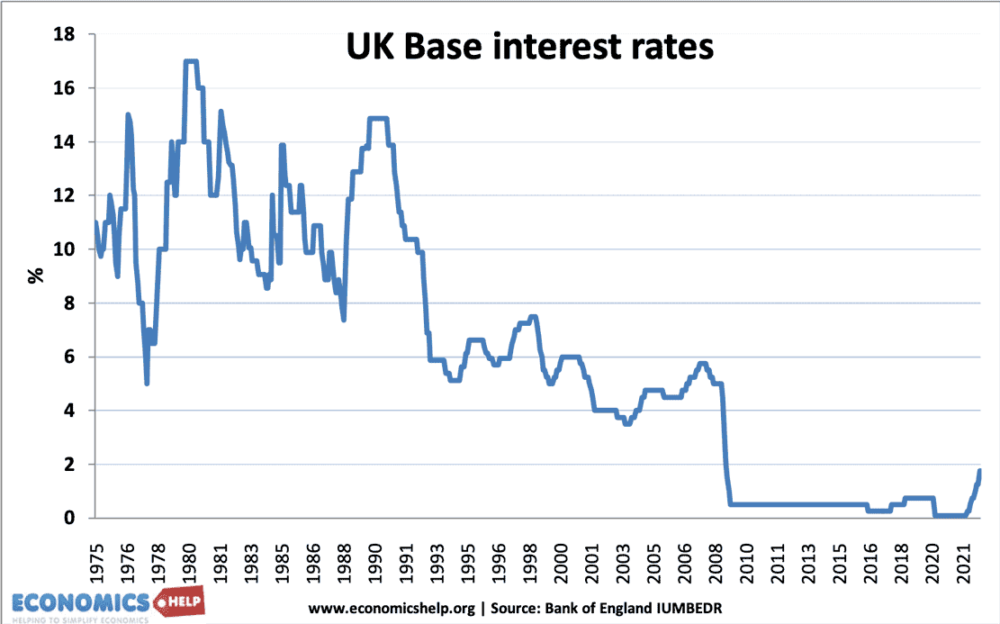

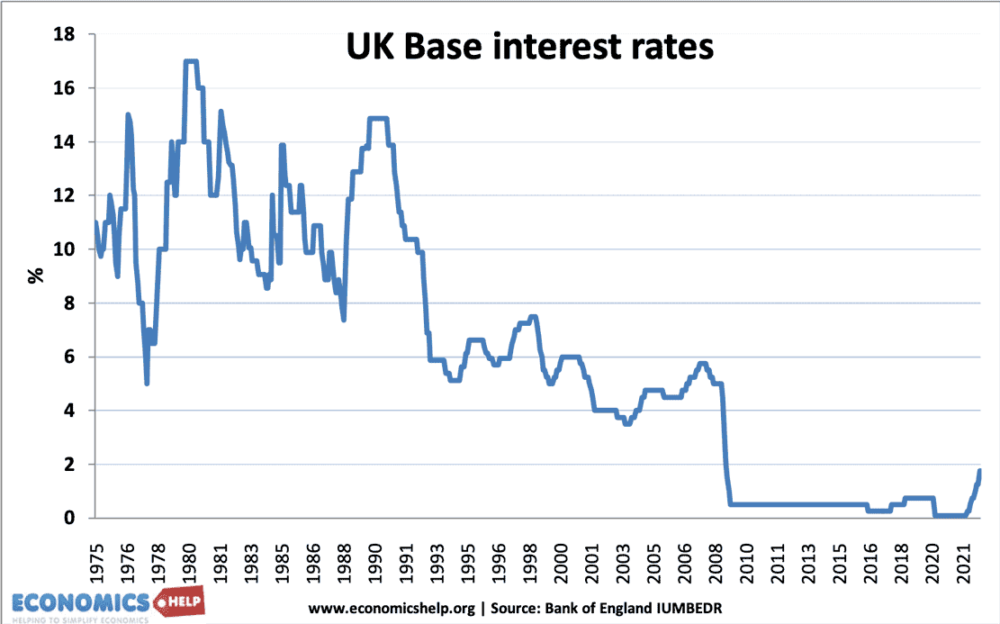

Why did the Tories get kicked out if the economy was booming? Is it because only a few years before people lost everything because of Majors ERM vanity project and the Tories fix which involved 17% interest rates? Would that be it? Feel free to argue that the economy was not booming in 1997 - what do you base this metric on? With regards to your point about the ERM, the biggest advocate for ERM membership was a Mr Gordon Brown - I wonder what happened to him? I didn't make such a claim. I pointed out the chaos that went before. The classic Tory game of hiking interest rates to fleece the poor and nest the rich. Those interest rates that miraculously plunged in election year.   |

|

|

|

Post by Pacifico on Feb 10, 2023 7:51:00 GMT

Feel free to argue that the economy was not booming in 1997 - what do you base this metric on? With regards to your point about the ERM, the biggest advocate for ERM membership was a Mr Gordon Brown - I wonder what happened to him? I didn't make such a claim. I pointed out the chaos that went before. The classic Tory game of hiking interest rates to fleece the poor and nest the rich.

Those interest rates that miraculously plunged in election year.   Bank base rates rose after Labour won in 97. |

|

|

|

Post by zanygame on Feb 10, 2023 20:28:27 GMT

I didn't make such a claim. I pointed out the chaos that went before. The classic Tory game of hiking interest rates to fleece the poor and nest the rich.

Those interest rates that miraculously plunged in election year.   Bank base rates rose after Labour won in 97. Oh yes, lets have a look. Lol.  |

|

|

|

Post by see2 on Feb 10, 2023 20:40:14 GMT

You are a LIAR ^^^ that makes your post worthless. Just a silly post from a poster of silly posts. If you had a thinking brain you would have noticed that I was referring to what "seemed to be" i.e. that's the appearance they give with their immature control of the media. And it never referred to all products of the grammar school system, just the knob heads. Private schools, Comprehensives, secondary moderns, church schools, home educated etc don't produce what you childishly call knob heads? Only grammar schools do so? Not sure how you manage to produce such a childish post, but FYI, referring to someone or some people as a 'knob head-s' is one way of insulting them. |

|

|

|

Post by see2 on Feb 10, 2023 20:44:55 GMT

Why does the government collect taxes? To spend quite a lot on waste. Certainly in the eyes of many, but a government with no income can't do any of the positive things that need to be done. |

|