Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Aug 6, 2023 22:03:20 GMT

In answer to the thread title, ‘because its the only thing they can do even when its f*******g useless When Maggie told her brilliant chancellor to shadow the mark and sent the country into chaos, nobody had fixed term fixed rate mortgages. Apart from bankers. As a result a 0.25% hike caused havoc and the rise from 8.5% to 17.5% emptied housing estates and saw the rise of the repo man. Today, the bank of england have only the same weapon but it has no effect on many who are on a fixed rate and wont feel the pain for another two or three months But the bank, oblivious of this, carry on hiking Which is why a percentage levy on income instead would work much more effectively because its effect would be spread more widely and fairly as well as being felt immediately. |

|

|

|

Post by Orac on Aug 6, 2023 22:17:35 GMT

I'm not assuming this. I am not engaging that part of the discussion because it is silly . Inflation is a change in the relationship between the scarcity of goods and the scarcity of money. You might search for root causes, but only some of this is under your control and saying that goods are too scarce is just a different way of saying that money is too un-scarce. There is an imbalance is between expectation and reality and , unless you intend to bend reality by (say) magically increasing productivity, you should adjust expectations. It's not a matter of culpability. The time price of money is just another price built out of the expectations of both the lender and the borrower. What you propose to do is save the borrower from his own decision if something goes wrong with his evaluation - this massively encourages borrowing, indeed even reckless borrowing and it does so at the expense of those who did not borrow or do not have a debt. Do you see how this twists things? And you appear to be equating an intent to punish borrowers - when there is none - with the real intent of reducing demand as a way of lowering inflation. A temporary Anti-inflation Levy on income would do the latter more effectively because it would rein back spending power on a much broader range of people, much more immediately, with those with the greatest and thus most inflationary spending power paying the most, the proceeds of such being put to far better use than boosting bank profits.. I'm doing nothing of the sort and this is about the fourth time in a row you have responded to an economic / incentive argument by asserting that I must want to blame or punish borrowers. The reason why interest rates are used is partially incentives. The problem for your position is that you are determined to keep the same incentives in place - well actually, you intend to amplify them by providing some precedent of a safety net for bad borrowing. Additionally, but rather secondarily, a scenario in which a government would collect extra taxation and actually use it to pay down debt rather than buy votes, is rather fantastical. |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Aug 7, 2023 7:24:11 GMT

And you appear to be equating an intent to punish borrowers - when there is none - with the real intent of reducing demand as a way of lowering inflation. A temporary Anti-inflation Levy on income would do the latter more effectively because it would rein back spending power on a much broader range of people, much more immediately, with those with the greatest and thus most inflationary spending power paying the most, the proceeds of such being put to far better use than boosting bank profits.. I'm doing nothing of the sort and this is about the fourth time in a row you have responded to an economic / incentive argument by asserting that I must want to blame or punish borrowers. The reason why interest rates are used is partially incentives. The problem for your position is that you are determined to keep the same incentives in place - well actually, you intend to amplify them by providing some precedent of a safety net for bad borrowing. Additionally, but rather secondarily, a scenario in which a government would collect extra taxation and actually use it to pay down debt rather than buy votes, is rather fantastical. I am not suggesting any kind of safety net for so called "bad borrowing". It has nothing to do with incentivising or disincentivising borrowing. I am proposing a far fairer, quicker and more effective tool against inflation. It would have no direct effect upon borrowing at all which already has substantial interest attached, beyond individuals having slightly less funds to afford to finance that borrowing. You are obsessed with the notion of rate rises serving to punish borrowers when their justification is actually to curb inflation by curbing demand. A temporary levy on incomes would do that far more fairly, far more immediately, to far better effect. Any desire to punish mortgage payers and other borrowers is a complete irrelevance and not the aim at all. |

|

|

|

Post by Pacifico on Aug 7, 2023 7:43:15 GMT

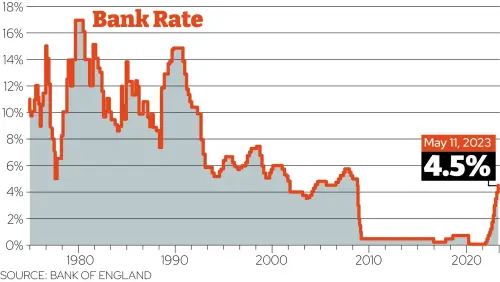

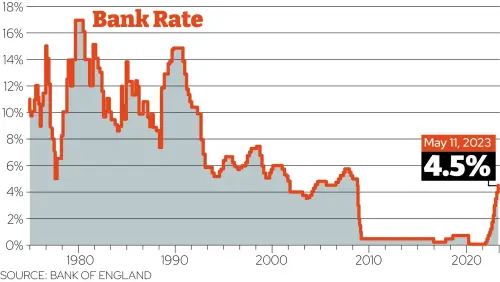

I didn't see the need for last weeks rise in interest rates but I would just say that they have only gone up to the rate where they should have been all along..  |

|

|

|

Post by Orac on Aug 7, 2023 8:52:01 GMT

I'm doing nothing of the sort and this is about the fourth time in a row you have responded to an economic / incentive argument by asserting that I must want to blame or punish borrowers. The reason why interest rates are used is partially incentives. The problem for your position is that you are determined to keep the same incentives in place - well actually, you intend to amplify them by providing some precedent of a safety net for bad borrowing. Additionally, but rather secondarily, a scenario in which a government would collect extra taxation and actually use it to pay down debt rather than buy votes, is rather fantastical. It has nothing to do with incentivising or disincentivising borrowing. It has everything to do with this. The economy is not a static object, it is a dynamic equilibrium created by incentives (rewards). Let's create an imaginary scenario - the government decides to tax people and hold the cost of borrowing low, as you suggest, and in response, people borrow more to make up the shortfall created by the extra taxation. What is needed to deal with inflation is a broad movement away from spending / borrowing and into saving / investing / producing. Unfortunately, the 'powers that be' have rigged the economy for the last decade in order to hold power and so everyone is invested up to their neck in all the wrong activities that only make sense if the rigged economy is held in place. This should have been corrected a decade ago. There are various discussions to be had here - for instance, how the political use of house prices diverts resources away from production and encourages debt. |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Aug 7, 2023 9:28:44 GMT

It has nothing to do with incentivising or disincentivising borrowing. It has everything to do with this. The economy is not a static object, it is a dynamic equilibrium created by incentives (rewards). Let's create an imaginary scenario - the government decides to tax people and hold the cost of borrowing low, as you suggest, and in response, people borrow more to make up the shortfall created by the extra taxation. What is needed to deal with inflation is a broad movement away from spending / borrowing and into saving / investing / producing. Unfortunately, the 'powers that be' have rigged the economy for the last decade in order to hold power and so everyone is invested up to their neck in all the wrong activities that only make sense if the rigged economy is held in place. This should have been corrected a decade ago. There are various discussions to be had here - for instance, how the political use of house prices diverts resources away from production and encourages debt. You are making a number of other salient points - eg the diversion of resources into house prices instead of investment which is a valid point, albeit something of a digression. The primary reason for this investment in property is an insufficiency of housing supply pushing up prices and thereby creating a situation where property becomes the best investment rather than in anything more productive. But punishing mortgage payers - quite apart from being an ineffective tool against inflation with so many of them on fixed terms - does nothing to address the central problem of an insufficiency of housing, and anyone losing their home because of it still has to live somewhere, often in rented accommodation which adds to inflationary pressures on rents. Insofar as home grown inflation is concerned, what needs to be done in the medium to long term is increase supplies of housing and anything else - eg labour - which we have a home grown shortage of, as well as doing all we can to reduce our reliance on expensive commodity imports. But in the short term all we can really do is dampen demand, and to do this effectively it needs to start working immediately, and to do it in a manner that is affordable to almost everyone without penalising just some and leaving others to spend freely. A temporary percentage levy on incomes would do that much more fairly and effectively. Without quite spelling it out you seem to be regarding those in debt and with mortgages as exclusively responsible for inflation, when in fact those with plenty of money to spend are bound to be more so. You have yet to acknowledge that individuals' debts are not the primary source of inflation but an insufficiency of supply is. Yet you want to target mortgage payers and other borrowers exclusively so that you dont have to make any sacrifices yourself, apparently viewing getting a mortgage as "bad borrowing". Again you seem obsessed with the notion of punishing debt and conflating that with the need to reduce inflation, as if punishing debt is the only and most effective way of doing that. I have explained why it is not. Many loans are on fixed rates and unaffected by rate rises. Many mortgages are on fixed terms for a period. So any impact on borrowers in the short term is very limited and thus very ineffective as an anti-inflationary measure. A levy on income would work immediately, spread the cost far more widely, and in a fair manner based on ability to pay. And the proceeds could be used far more constructively. |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Aug 7, 2023 9:50:04 GMT

I didn't see the need for last weeks rise in interest rates but I would just say that they have only gone up to the rate where they should have been all along..  The correct level for interest rates is a separate issue from the use of them as a tool against inflation. You may well be correct that the current rates of interest are more in line with where they are supposed to be. The headline rate after all was only as low as it was in reaction to the 2008 crash. Although I will point out again that no one with a personal loan or a credit card, paid interest at anywhere near as low a rate as that, so debt has always come with a cost for non mortgage borrowers. And whilst mortgage interest was for a time exceptionally low, this was counteracted by exceptionally high house prices insofar as hitting people in the pocket was concerned. For some, a mortgage was only feasible because of the low rates, yet at the same time a no brainer because it was usually cheaper than renting. Alas has our housing market been so distorted. But as a tool against inflation, interest rates are very ineffective, because their impact is limited only to those with mortgages or other debt. And in the short term the impact is even more limited since most personal loans, car purchases, etc are on fixed rates for their entire duration, regardless of what the base rate is doing. Whilst credit card interest was in most cases already so high that most of them have appeared to have absorbed most of the impact, passing little of it on. And many mortgage payers are on fixed terms for a period so only gradually will they be impacted and not immediately in many cases. So as a means of reducing inflation by reducing demand, achieved by making borrowers poorer, it is bound to be highly ineffective, particularly in the short term, even whilst being financially disastrous for a few. A levy on income instead would impact many more people and do so immediately, but in a way intrinsically linked to the ability to pay, and thereby resulting in far fewer people being driven to utter destitution whilst everyone else spends freely, yet reducing demand much more quickly and effectively. It would thus be far more effective as an anti-inflationary tool, with the proceeds being put to far better use than the swelling of bank profits. |

|

|

|

Post by Orac on Aug 7, 2023 10:18:50 GMT

It has everything to do with this. The economy is not a static object, it is a dynamic equilibrium created by incentives (rewards). Let's create an imaginary scenario - the government decides to tax people and hold the cost of borrowing low, as you suggest, and in response, people borrow more to make up the shortfall created by the extra taxation. What is needed to deal with inflation is a broad movement away from spending / borrowing and into saving / investing / producing. Unfortunately, the 'powers that be' have rigged the economy for the last decade in order to hold power and so everyone is invested up to their neck in all the wrong activities that only make sense if the rigged economy is held in place. This should have been corrected a decade ago. There are various discussions to be had here - for instance, how the political use of house prices diverts resources away from production and encourages debt. Insofar as home grown inflation is concerned, what needs to be done in the medium to long term is increase supplies of housing and anything else - eg labour - which we have a home grown shortage of, as well as doing all we can to reduce our reliance on expensive commodity imports. Without quite spelling it out you seem to be regarding those in debt and with mortgages as exclusively responsible for inflation Building houses and bringing people in does nothing (of course) to address a housing shortage. There is no amount of housing that can be built which would equalise with a potentially infinite pool of externally sourced demand. The more you build the more will come until you have destroyed our economy. There is no shortage of people (labour) in the UK. However, there is perhaps a shortage of productivity (ie specific wealth produce per labour) - adding more people mindlessly will just reduce productivity further .One thing you could do is have a bonfire of legislation which would allow UK companies to ditch their useless third. Again - it's not a matter of responsibility, it is a matter of incentives |

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Aug 7, 2023 10:36:13 GMT

Insofar as home grown inflation is concerned, what needs to be done in the medium to long term is increase supplies of housing and anything else - eg labour - which we have a home grown shortage of, as well as doing all we can to reduce our reliance on expensive commodity imports. Without quite spelling it out you seem to be regarding those in debt and with mortgages as exclusively responsible for inflation Building houses and bringing people in does nothing (of course) to address a housing shortage. There is no amount of housing that can be built which would equalise with a potentially infinite pool of externally sourced demand. The more you build the more will come until you have destroyed our economy. There is no shortage of people (labour) in the UK. However, there is perhaps a shortage of productivity (ie specific wealth produce per labour) - adding more people mindlessly will just reduce productivity further .One thing you could do is have a bonfire of legislation which would allow UK companies to ditch their useless third. Again - it's not a matter of responsibility, it is a matter of incentives Increasing the supply of labour need not necessarily involve "bringing people in". It could involve training more of our own people up, putting structures in place that make certain types of job a much more viable option for more people, encouraging the economically inactive back into the workplace. But insofar as we do need to allow more people in then we have to provide the housing for them as well as for those already living here and born here. We have failed to build sufficiently for those already here though, let alone anyone else. And no one comes here because they see houses being built. They come here for the work. Not building any houses will not stop them coming. How we do stop them coming is another thread altogether. And a bonfire of legislation is a beloved mantra of the right, which tends to fall flat on it's face when you get down to the detail. Because most legislation exists for a very good reason, either to prevent abuses, guarantee workplace safety, deliver reasonable entitlements to paid holidays or maternity leave of whatever it may be. Legislation only ever comes into existence to address a perceived problem at the time or to enforce a desired right. If you can think of any that serves no useful purpose I am all ears because pointless bureaucracy is a problem. Though for those involved in imports and exports by far the greatest source of added bureaucracy has been Brexit itself. As for productivity, low pay and cheap labour have long been a big part of the problem. After all, why invest in expensive labour saving technology when you can hire people so cheaply? Low pay itself incentivises low productivity by disincentivising investment in better processes. |

|

|

|

Post by johnofgwent on Aug 7, 2023 11:31:30 GMT

I think many are overlooking an elephant.

Before Brown’s sub prime boom and bust the board level manager with whom i engaged at the bank where i was developing the sub prime application software, a woman of South African origin, told me the sort of borrowing we saw in tbe UK was unheard of back home

In South Africa she told me, one took out a secured loan to buy a house, to move to a bigger house, to extend a house or to improve a house AND NOTHING ELSE

Taking out a secured loan on a house to go on holiday as some were doing back in 2009 was insane.

|

|